Ethereum’s value is slowly rising up again after dropping sharply to $2850 on the market. The first drop in the price of ETH was due to a market crash.

This crash was made worse by people not liking the ETH ETF because it didn’t raise the price of Ethereum as much as the Bitcoin ETF did. But a rise in the number of staked Ethereum coins gives us a better reason to be positive.

According to Coinbase the amount of ETH staked has increased significantly over the past few days. Almost a record-high 27.18% of all the ETH that is out there is being staked right now. This number shows that 32.7 million ETH tokens have been staked, which is a lot more than usual.

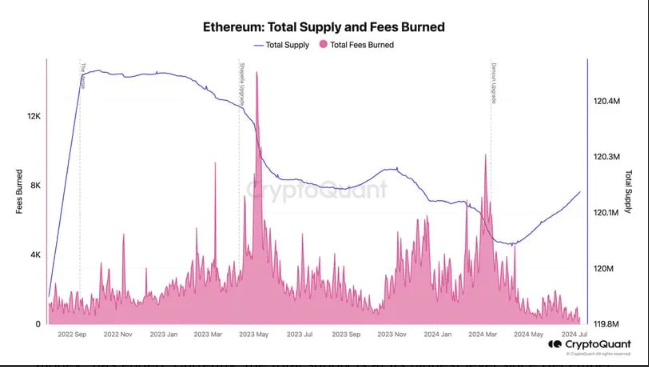

Ethereum Supply Levels Increase

Investors are more interested, as shown by the rise in staking. This could help ETH’s comeback. It’s worth $3,179.00 now, but it lost 10% of its value in the last month. It has since gained some of that value back after the crash.

Along with more people staking, the total amount of Ethereum being available is also growing, hitting levels not seen since December 11, 2023. The circulating supply stays the same, even though the quantity is growing.

12% of the ETH supply is locked up in smart contracts and bridges, according to data from Coinmetrics. Another 40% of tokens are also locked up and not being sold.

Investors can’t wait for the U.S. Securities and Exchange Commission (SEC) to decide next week whether on-the-spot Ethereum ETF trade is legal. Analysts think that this approval could have a major impact on Ethereum’s price, which could make buyers buy more ETH in the optimism of further gains.

Some well-known people in the crypto world, like Justin Sun, the founder of the TRON blockchain, are also buying more ETH. According to data from SpotOnChain, Sun just bought 1614 ETH tokens for $5 million in USDT, which is $3097 per token.

This comes after news sources said Sun may have lost more than $60 million when the price of ETH dropped during the market drop.