Millions of dollars have been taken out of the Grayscale Ethereum Trust ETF (ETHE), which has made people worry about the fund’s future. Since July 26, ETHE has lost $356 million. If things keep going the way they are, the Ether stocks could run out in a few weeks.

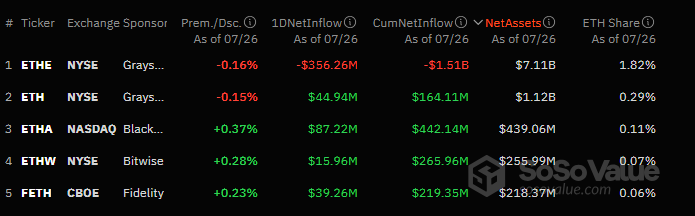

SoSo Value data shows that spot Ether (ETH) exchange-traded funds (ETFs) had a very volatile July 26. There were total net withdrawals of $163 million.

With this much volatility, Grayscale’s newly converted Ethereum Trust ETF has been hit hard. Since spot Ether ETFs started trading in the US on July 23, over $1.5 billion has been withdrawn from the fund.

While money was leaving ETHE, Grayscale’s Ethereum Mini Trust ETF (ETH) had a net inflow of $44.9 million on July 26, bringing its total net inflows to $164 million since the start. This shows that investors aren’t all following the same direction. Some of Grayscale’s Ethereum-related products are still valuable to them.

But most of the money has been put into BlackRock’s iShares Ethereum Trust ETF (ETHA). On July 26, $87.2 million was added to it. ETHA now has a net worth of $442 million, which makes it one of the best Ethereum ETFs.

Grayscale’s Impact And Market Dynamics For Spot Ether ETFs

At the moment, spot Ether ETFs have a net asset value of $9.2 billion. The ETF net asset ratio, which shows how much ETFs are worth compared to Ethereum’s whole market value, is 2.36 per cent. In spite of these numbers, spot Ether ETFs have lost a total of $341 million over their history.

After getting the go-ahead from the US Securities and Exchange Commission in May, eight investment firms launched nine new Ethereum exchange-traded funds on July 23. These funds will track the cryptocurrency’s live price. With so many new ETFs coming out, the market is now very active and competitive, which changes how investors act and how well funds perform.

The Grayscale Ethereum Trust ETF reveals how challenging and vague things are for spot Ethereum ETFs. A large sum of money therefore disappeared from it. Investors are attentively observing these events since ETHE’s low stocks significantly influence the Ethereum ETF market.

How Grayscale and other ETF providers respond to the developments and whether they come up with fresh ideas for income generation and client money security will greatly pique people’s curiosity.