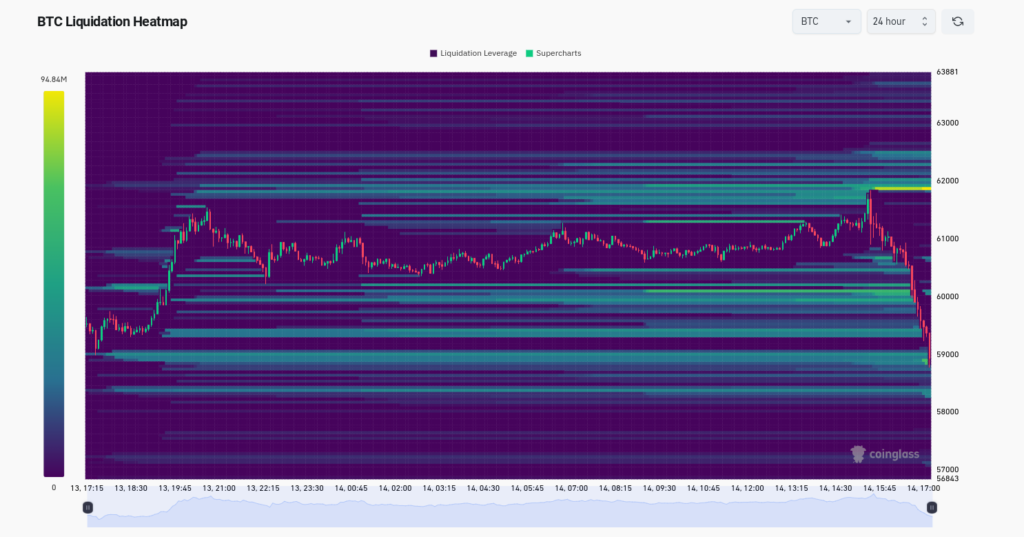

Bitcoin dropped quickly by 5% on August 14 after rejecting a Consumer Price Index (CPI) report that was lower than expected. This caused market instability.

Following the CPI report, which was lower than expected and was expected to boost risk assets such as cryptocurrencies, data from Analyst and TradingView showed that Bitcoin quickly spiked to almost $62,000.

Bitcoin Rise Short-Lived

But the rise didn’t last long. Within a little over an hour of hitting $61,809 on Bitstamp, BTC/USD fell more than 3%.A well-known trader named Daan Crypto Trades was worried that prices might change erratically in response to U.S. macroeconomic data.

He was relieved that the CPI report mostly met predictions. “CPI mostly coming in at guesses. “Pretty good, and I don’t think this will have significant impacts on markets in the end,” he wrote on X.

“Likely for the markets to do whatever they wanted to do anyways. At least no crazy upside or downside surprise is good.”

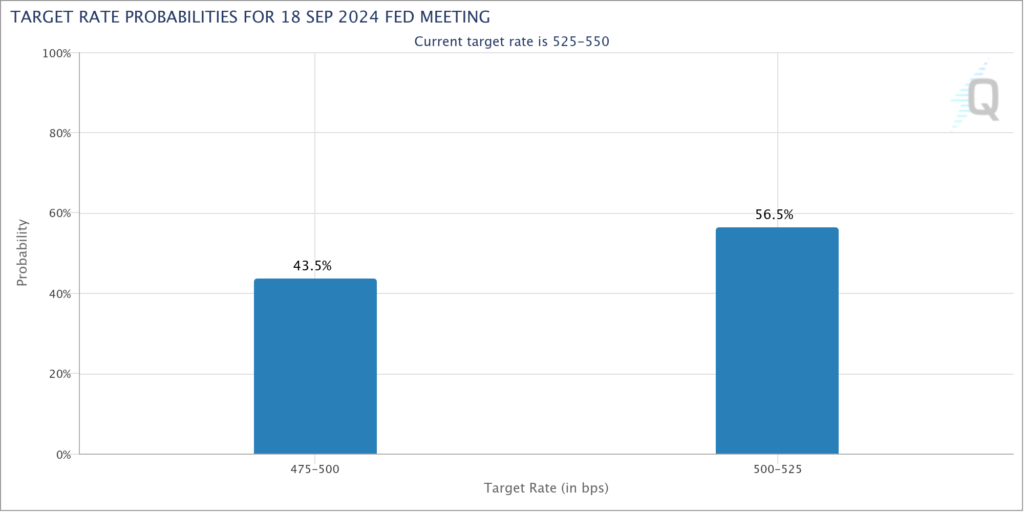

The FedWatch Tool from CME Group showed that markets are still expecting the Federal Reserve to cut interest rates by a small amount at their next meeting in September. A trade paper called the Kobeissi Letter said on X that the drop in headline inflation could cause the Fed to lower interest rates.

“However, as rate cuts come, inflation in some categories will begin rising again.”

Trader Roman noticed that Bitcoin could drop another 10% from where it is now because there isn’t enough trade to support higher prices. He said that the price might drop to $58,000 or even $55,000 before it becomes a good time to buy. Roman also said that the $61,900 mark is starting to act as resistance.

“My plan has remained unchanged for the last week. Not seeing strength here for continuation upwards as we have bearish price action (low vol + price up).”