For the first time in almost two years, a strong positive signal for Bitcoin has shown up, suggesting that the value of the cryptocurrency could double. Jamie Coutts, head crypto analyst at Real Vision, has been keeping an eye on the signal. It comes from a global liquidity model that has been linked to major price increases in the past.

On August 15, Coutts brought attention to this signal through X, pointing out that it had been linked to major Bitcoin gains in the past, like a 19-fold rise in 2017 and a 6-fold rise in 2020. He thinks this hint could mean that the price of Bitcoin will go up by two to three times.

“My composite global liquidity momentum model (MSI), has provided the first Bullish regime signal since November 2023. Recall that Bitcoin rallied 75% from Nov to April before the regime flipped Bearish”

Bitcoin’s Global Liquidity Support

However, the bullish outlook depends on a number of things, such as how the US Dollar Index (DXY) does and how liquid the market is generally. There are short-term problems for Bitcoin because more than $1.4 billion in options on the cryptocurrency will expire on August 16 at 8:00 am UTC if it doesn’t rise above $60,000.

“For BTC to meet this target, the DXY would need to be well below 101, prompted by ongoing central bank injections. This would push global M2 well over $120T this cycle.”

The price of BTC may be supported by the growing global funds supply. The Bank of Japan recently added $400 million and the People’s Bank of China added $97 billion, adding up to a $1.2 trillion rise in global liquidity in the last month.

“This is the natural state in a credit-based fractional reserve system. The funds supply must continually expand to support the outstanding debt. Otherwise, everything will collapse.”

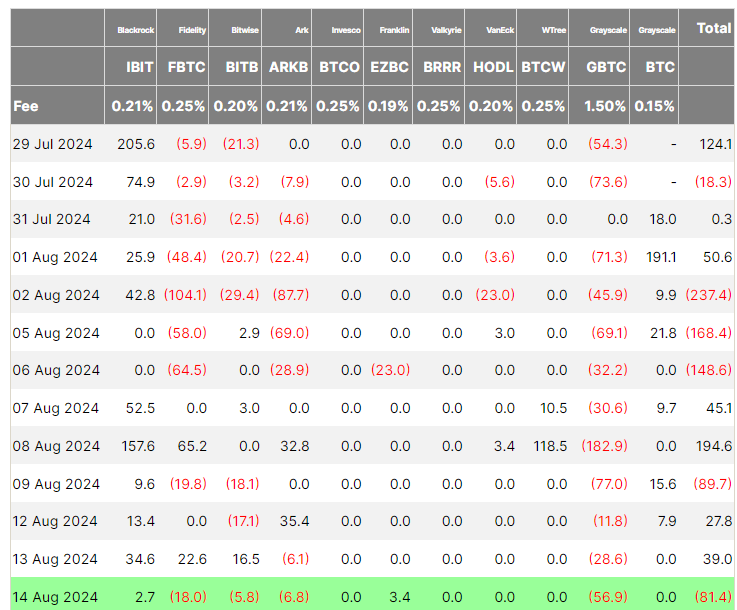

Even so, Bitcoin’s price path will also be affected by funds coming in from US spot Bitcoin exchange-traded funds (ETFs), which have been flat lately. According to data from Farside Investors, on August 14, ETF inflows went negative, with $81 million leaving US ETFs.