Recent developments in the cryptocurrency market suggest a potential price drop for Solana (SOL) to the $80 mark.

On Aug. 31, the on-chain analytics firm Lookonchain reported via X (formerly Twitter) a significant move by a crypto whale or institution involving the transfer of 139,532 SOL, valued at approximately $19.5 million, to the Binance exchange at a loss of $5.5 million.

According to extensive research, the whale wallet identified by the address “FkVrB first unstaked the stated amount of SOL before putting it into Binance two days ago. Records show that this wallet bought the SOL in July 2024 for $180, most likely in expectation of sanctioning a Solana Exchange Traded Fund (ETF) in the United States.

SOL’s market performance has subsequently struggled to match these former heights, and present indications point to a volatile future despite these high expectations.

Solana Price Prediction

According to expert technical analysis, Solana (SOL) is teetering at a pivotal support point of $127. On the daily chart, Solana is trading below its 200-day exponential moving average (EMA), indicating a possible continuation of the present downtrend.

Historical records point to a trend whereby SOL usually sets out on a significant rally once reaching this important support level. Analysts estimate a possible forty percent increase to the $180 mark if the trend maintains. There is a risk that if SOL falls below and closes a daily candle under the $120 mark, it could slide into the next support level at $80.

Recent on-chain Solana metrics reflect a negative view. Data from CoinGlass shows that at -0.0034%, the SOL Open Interest (OI) weighted financing rate is rather negative. This figure shows that short sellers are now dominating, usually liquidating long positions. For SOL, this bearish attitude can cause more losses soon.

Solana Trading Price

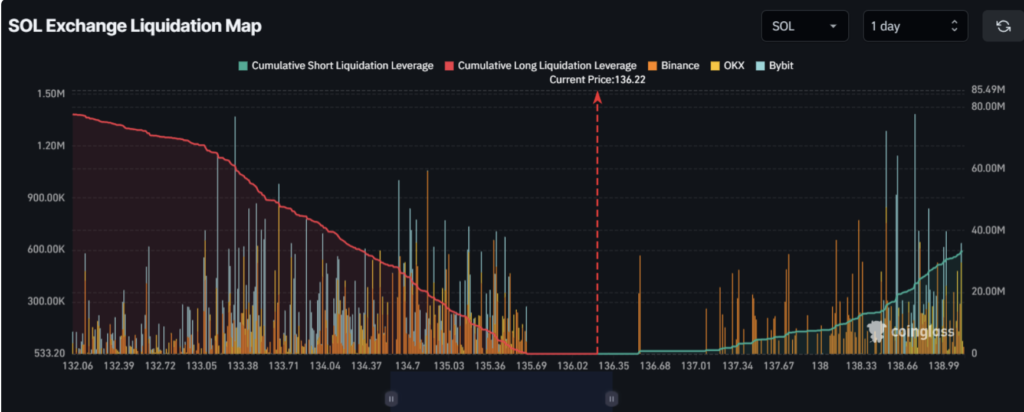

Recent data from CoinGlass indicates that Solana’s (SOL) main liquidation levels are currently set around $139 on the upside and $133.3 on the downside. These levels suggest that traders at these pricing points have notable over-leveraging.

If SOL’s price falls below $133.3 and the market attitude remains adverse, around $60 million in long holdings might be sold off. Conversely, a turn toward a positive attitude that drives the price up to $139 might cause the liquidation of perhaps $21.5 million in short positions.

As of the latest update, SOL is trading around $132, marking a slight increase of over 3.69% in the past 24 hours. However, open interest dropped 2% over the same period, indicating a decline in trading involvement during the continuous market crisis.