After surging from $62,050 on Sunday to a peak of $66,500 by late Monday, bitcoin corrected slightly below the resistance level before rising sharply. In Tuesday trading, it stayed above $65,000.

The rally was also enabled by several factors including a short squeeze, stronger demand for the spot market and substantial inflows into US Bitcoin Exchange Traded Funds (ETFs). The liquidation of leveraged short positions was a major driver behind Monday’s surge. QCP Capital said short positions on Bitcoin and Ethereum worth nearly $80 million were erased, channeling these assets upward.

Bitcoin Rally Influenced By Delay

The news that the repayment to Mt. Gox wasn’t until October 2025 influenced the rally some believe was due in part to the delay. Bitcoin’s timing is similar to past US election cycles, QCP Capital points out.

In 2016 and 2020, the cryptocurrency historically rallied about three weeks lead up to Election Day, accompanied by strong price moves in the months afterward. Just weeks before the US elections, this year’s rally points to a potential repeat of that trend.

The muted performance of Bitcoin in October, a month known as “Uptober” for unusually strong gains, is only up 1.2 percent this year, compared with a typical 21%. But the recent rally has fueled talk of more to come from greater investor optimism.

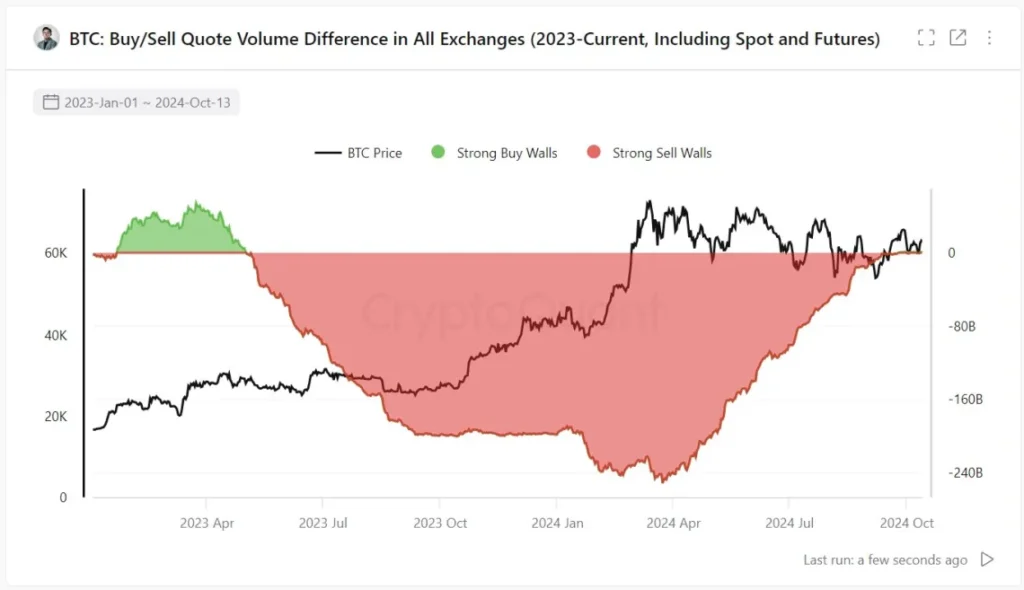

For the first since mid 2023 Bitcoin buy orders are matching sell orders across exchanges. It comes after a run in which sell orders had been more prevalent.

And big capital influxes to BTC ETFs happened, with $555.9 million inflowing on Monday; large asset managers like BlackRock and Fidelity caning pulling in major capital; institutional interest is growing. ‘They’re beginning to show growth,’ Nate Geraci, CEO at ETF Store, told TechCrunch, adding that the inflows aren’t coming from retail speculators.