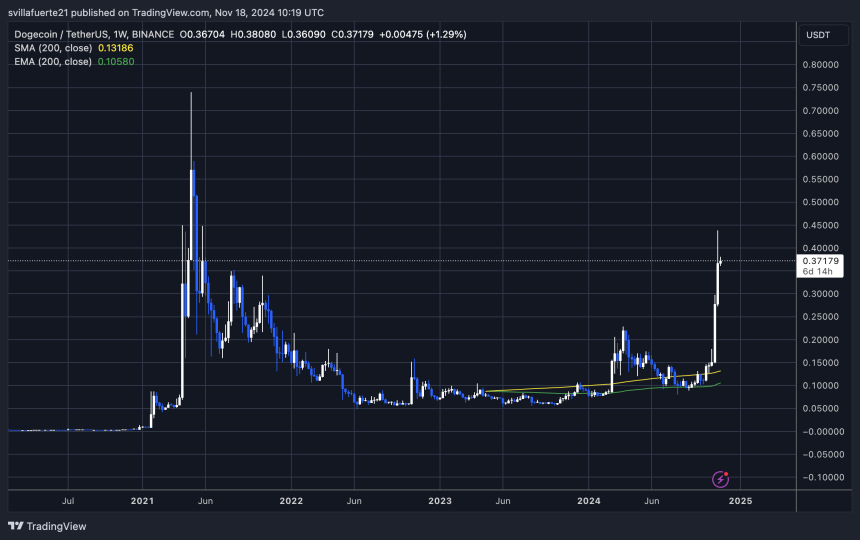

Over the last two weeks, Dogecoin (DOGE) has surged 200 percent, and it’s now consolidated at $0.287, its highest level since May 2021. Crypto analyst Carl Runefelt spotted a breakout of a bullish falling wedge pattern, predicting $0.4385 as a short term target, or 18 percent upside.

DOGE’s rally shows how powerful they are and how much they are taken seriously and makes one believe that they are going to remain at the top of the meme coin market capitals. The coin has shown strength and again attracted the interest of investors by remaining above crucial support levels.

The surge, according to Runefelt, is due to increasing demand and positive sentiment but warns about a fake breakout. Under such scenario, volatility might be elevated or consolidation could extend. It is a healthy pause after its incredible run a retracement of dogecoin from last week’s local highs.

Dogecoin Momentum Tied To Market Trends

Closely watched by analysts is whether DOGE can maintain its momentum upwards and hold above critical demand levels. If these levels can be defended then the next leg higher can be successful in fueling DOGE’s dominance in the meme coin market.

The broader crypto market is one to watch, especially for Bitcoin and Ethereum and their performance affecting dominoes all the way down to altcoins. Analysts say if these market leaders keep up bullish momentum then DOGE’s next move will steer in their direction. Without official support, Dogecoin could take its price sideways or they could consolidate further.

DOGE has led meme coins lately, and together with other meme coins, they have outperformed traditional altcoins in the last weeks of explosive growth in the sector once more. DOGE’s ability to uphold strong support while rallying shows that it’s a real contender.

But they are still hesitant and the market is still trying to gauge its next steps. DOGE trending bullish is being watched by traders for confirmation or a patch. Dogecoin continues to serve as a focal point for investors taking an exciting approach regarding prudence in a volatile crypto landscape as it consolidates near key levels.