As the much-anticipated halving of Bitcoin gets closer, market experts are looking closely at key indicators to see if the event’s effects have already been taken into account by the market.

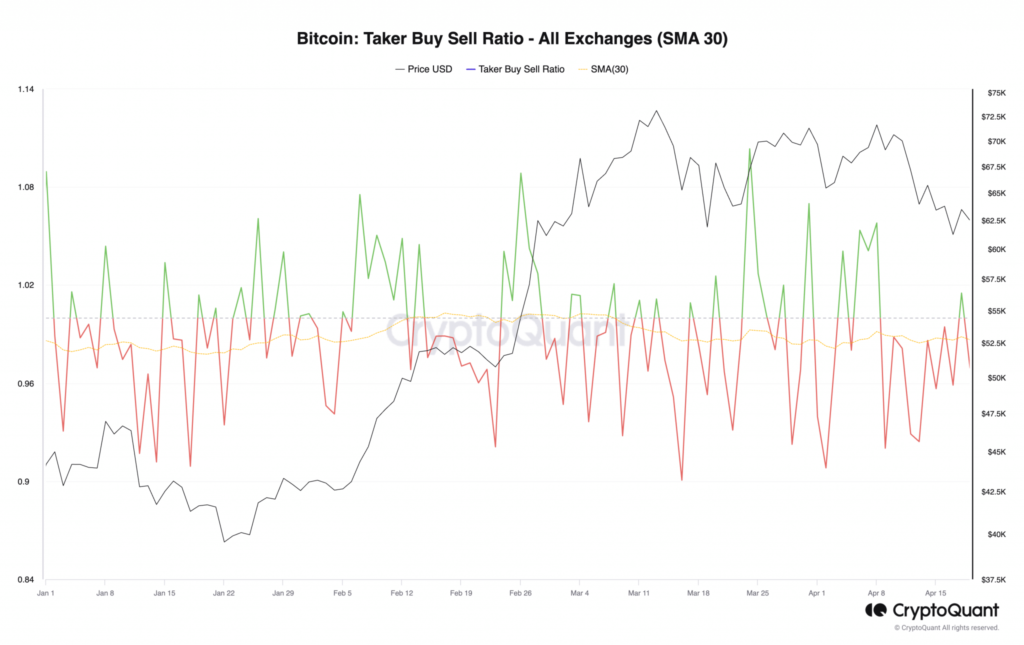

CryptoQuant’s most recent data shows that BTC’s buyer buy-sell ratio has changed significantly. It now falls below the center line, which means that there are more sales than purchases in the Futures market.

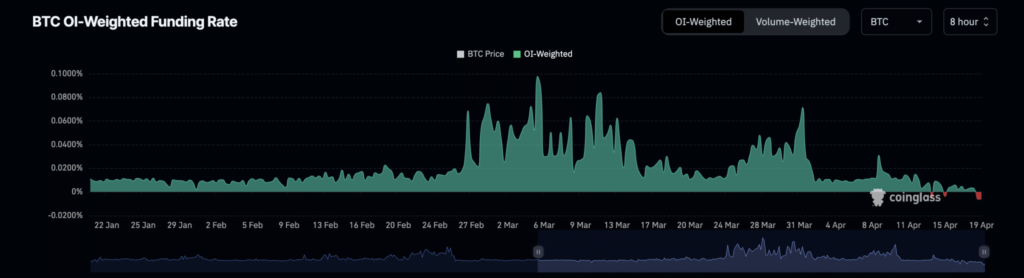

With the half event set for late April 19 or early April 20, people’s moods have become very negative in the last 24 hours. On many cryptocurrency platforms, the funding rate has gone negative, which means that more people are selling their coins short. Coinglass says this is only the second time since the market rise began in October 2023 that Bitcoin has had a negative funding rate. The first time was on April 15.

Bitcoin Futures Market: Analysts Concerned

Analysts are paying close attention to BTC’s Futures market, which has seen more trade and a rise in open interest that has led to it, which is now at $31.2 billion. Even with this rise, the large number of short positions, shown by the negative funding rate, shows that traders are protecting themselves against a possible downturn after the halving rather than betting on a bullish rally.

Technical analysis backs up the overall bearish mood even more. Since April 12, indicators like the Awesome Oscillator and the Elder-Ray Index have been regularly showing bearish signals. The Awesome Oscillator’s south-facing red histogram bars show that there is more pressure to sell, and the Elder-Ray Index’s negative values show that the market is mostly bearish.

Because these signs are coming together, experts are wondering if the market has already priced in the effects they think the halving will have. There may not be any truth to the rumors of huge price increases right before or after the half. This means that investors who were expecting such significant shifts may be in for a surprise.

As Bitcoin buyers get ready for the halving, the current state of the market shows how hard it is to tell what will happen. It’s still too early to tell if the halving will start a long-lasting bullish trend or if its effects have already been seen in the market. This leaves investors and experts alike on edge as the countdown continues.