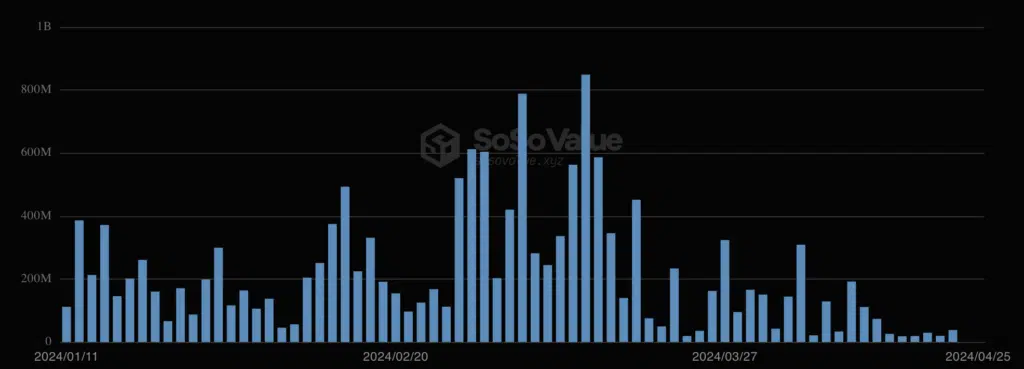

On April 25, a substantial $217 million capital outflow occurred in the spot Bitcoin ETF sector, marking the most recent event in the cryptocurrency market. Five ETFs had no change in funds, including BlackRock’s iShares Bitcoin Trust ETF (IBIT), according to data from SoSo Value. The BlackRock fund has not reported any capital intake for the second day.

In addition to BlackRock’s IBIT, four other ETFs had withdrawals: ARK Invest/21Shares, Fidelity Investments, Grayscale Bitcoin Trust (GBTC), and others. IBIT is one of the top 10 ETFs with a longer history of consistent capital inflows, even with its recent performance. Nevertheless, from March 2024, data shows a decrease in capital inflows into the fund.

BlackRock’s CEO Anticipates Surge in Institutional Crypto Investments

In the past several weeks, there has also been a noticeable decrease in the average amount of capital inflows into spot Bitcoin ETFs. According to Bitwise CEO Hunter Horsley, many institutional investors are subtly getting ready to pour large sums of funds into cryptocurrency-based products. Horsley is nevertheless upbeat, thinking that the growth of this new category of digital assets would make the cryptocurrency market even more alluring to investors.

Recent patterns, however, point to declining investors’ interest in cryptocurrency-based goods. Analysts at CoinShares have noted that $206 million in total has been taken out of cryptocurrency products intended for high-net-worth individuals throughout the last week.

The cryptocurrency market’s development is mostly determined by the movements of exchange-traded funds (ETFs) and investor sentiment. The recent withdrawal from BlackRock’s Bitcoin ETF highlights the unpredictability and volatility in this emerging market, with experts and investors on tenterhooks anticipating more moves.