Recent improvements to Ethereum (ETH) Layer 2 platforms have helped the price of the coin go over $3,200. This is a significant move forward for decentralized finance (DeFi). As these Layer 2 options grow, people are wondering what will happen to Ethereum’s Total Value Locked (TVL) and how that will affect the market as a whole.

A new study by analyst shows that the amount of Ether locked in Layer 2 solutions is growing. This marks a new milestone in Ethereum’s environment. The numbers show that the amount of Ether locked on these sites has gone over 12 million, which means that DeFi activity is growing very quickly.

Ethereum’s Locked Assets Surge

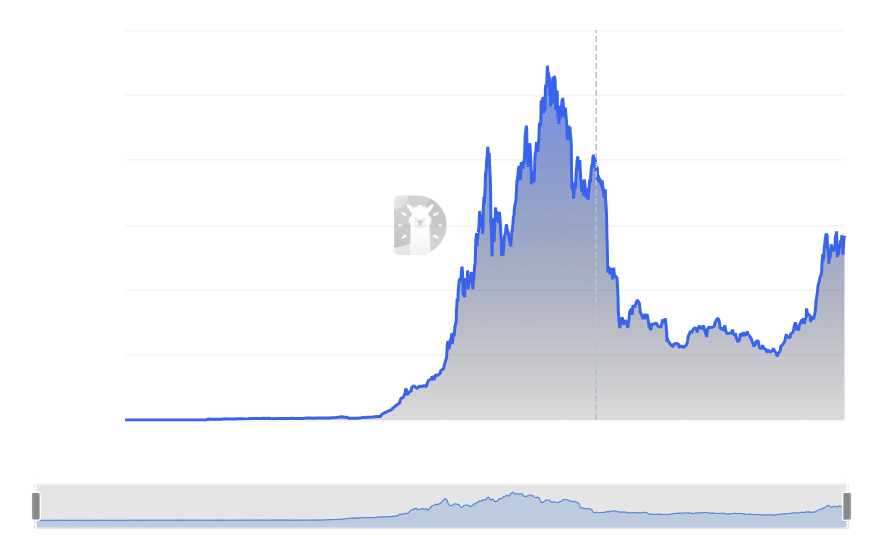

Even though the value of locked assets in dollars has reached an all-time high, mostly because of Ethereum’s rising price, the amount of locked Ether is now at an all-time high. But it’s important to keep in mind that changes in the market price of ETH can affect the value of locked assets in dollars. This adds another level of instability to the DeFi world.

When we look more closely at how Layer 2 TVL is broken down, we see that three main companies control more than 73% of all TVL. With about $16.6 billion locked up, Arbitrum has the most funds. Optimism and Base Protocol are next, with $7.33 billion and $5.55 billion, respectively.

Analysts studies of Ethereum’s TVL over the past few months show a changing pattern. The TVL has surpassed $50 billion and is staying at this level. In this surge, Layer 2 solutions have been very important, and they have also helped Ethereum’s general growth.

A look at ETH’s daily timeframe chart shows an optimistic outlook. The price of the cryptocurrency has gone up and is now trading at over $3,200. This upward movement along with a positive Relative Strength Index (RSI) points to a possible return to a strong trend in the near future.