Ethereum (ETH) has dropped to its lowest level in six months as Layer 2 solutions gain speed. This has completely changed the way the top blockchain network works. Vitalik Buterin, one of the co-founders of Ethereum, came up with a plan in 2020 to address worries about scalability by moving transactions away from the mainnet. This coincides with a drop in network activity.

As a lot of bears rushed into the market, the price of ETH went down. This made the effects of less network usage even worse. An data company called IntoTheBlock says that Ethereum’s transaction fees have gone down by over 29%. This is a major drop. The fees are going down at the same time that action is moving to more than 50 live Layer 2 networks. The way Ethereum works is changing because of this.

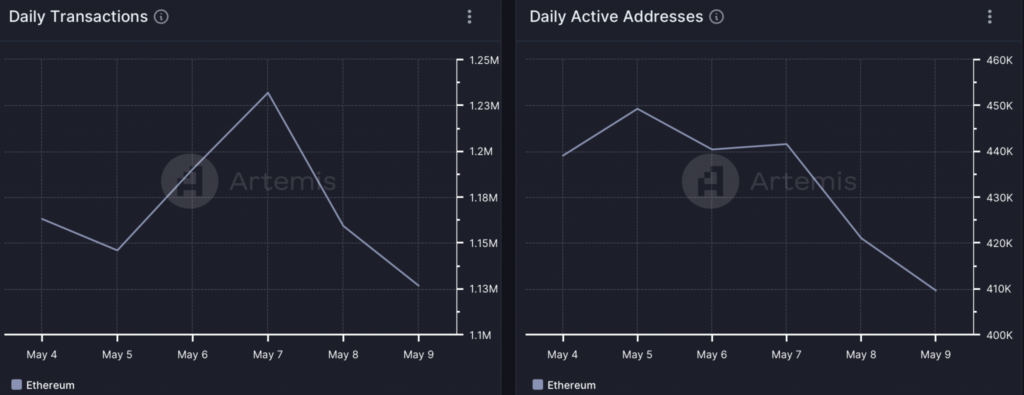

Analysts’ full study of Artemis data shows why Ethereum’s network activity is going down when you look at the numbers more closely. It’s clear that the number of Daily Active Addresses on the blockchain has gone down, which is in line with the drop in sales and income overall.

Ethereum’s Bearish Plunge

Ycharts reports that gas prices have dropped a lot over the past month, from 47.5 Gwei to 8.5 Gwei, which seems to be related to the drop in network traffic. Even though transaction costs went down, Ethereum’s network activity dropped, which could mean that the market as a whole is changing.

The bearish attitude reverberated across the market as Ethereum’s price took a hit, plummeting by more than 6% over the last seven days. With ETH trading at $2,920.99 and a market capitalization exceeding $350 billion, investors are closely monitoring the situation for signs of a possible reversal.

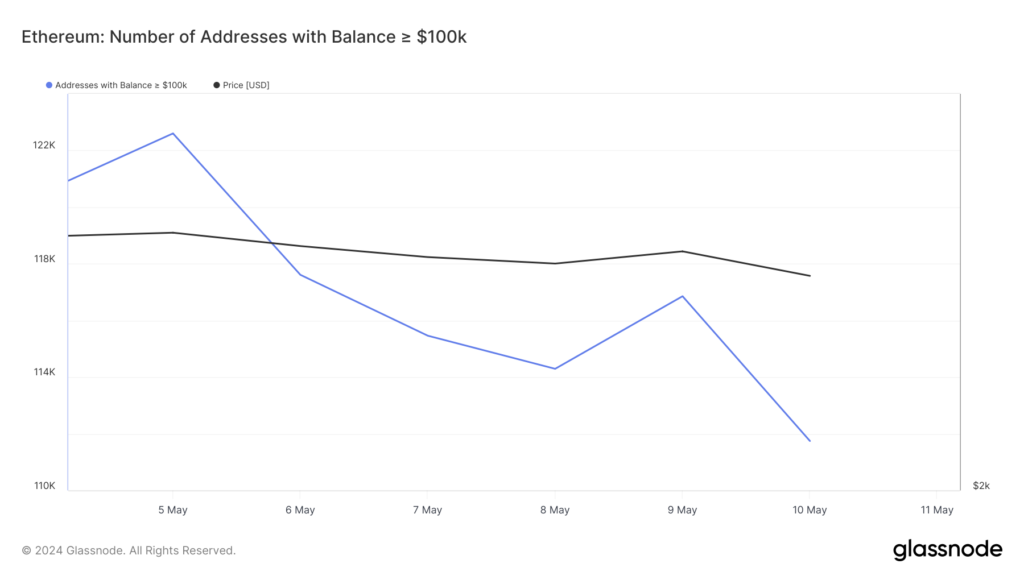

Looking more closely at Glassnode’s data reveals a worrying trend, the number of addresses with amounts higher than $100,000 has dropped by a large amount. The large number of whales leaving the market says that people are becoming more likely to take profits, which is making prices fall even more.

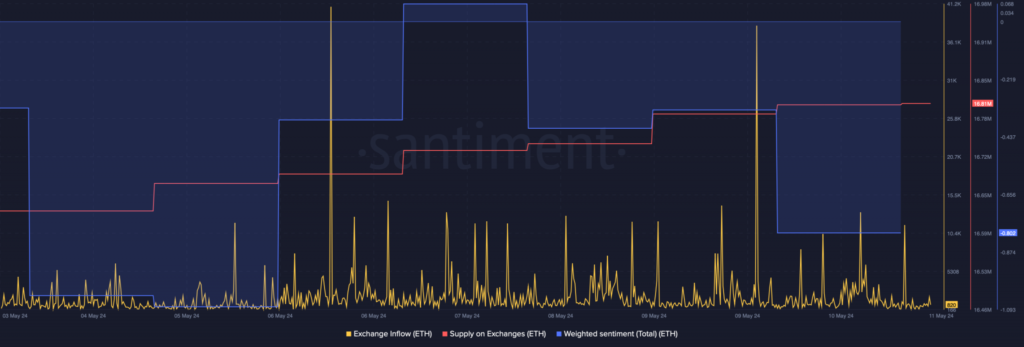

Sentiment research show that the market’s mood has gotten worse, as both exchange flows and supply have gone up. As you can see, buyers are less sure of themselves now that there is a quick rush to sell. This is why Ethereum’s value has been going down over the last few days.

Both of the indicators are going down. RSI is below the neutral level and MFI is going up. Things like these technical signs don’t look good for Ethereum in the short term. The price of ETH is still below its Simple Moving Average (SMA) for the past 20 days and close to the lower end of the Bollinger Bands. This means that experts believe the trend will soon change.