Bitcoin Runes began on the Bitcoin (BTC) blockchain slightly less than 30 days ago. However, there has been a major drop in activity, which is worrying people. Somebody named Casey Rodarmor made the Runes system. He also made Bitcoin Ordinals.

The plan was to change how fungible coins are made and handled on the blockchain.Runes were first thought of as a way to make Bitcoin more important. The price dropped in half around the same time that it became very famous.

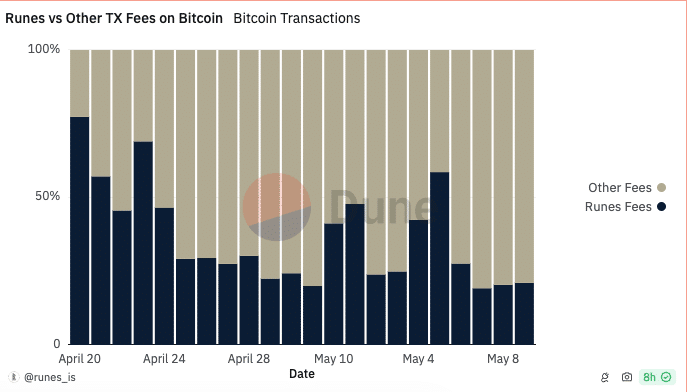

It is remarkable that the protocol made $135 million in fees in its first week. This shows that it is being used and is getting a lot of attention. But new information from Dune Analytics shows that a lot less is happening on the protocol than was thought.

Bitcoin Runes Fee Dynamics

At its peak, Runes’ fees made up a remarkable 77.3% of all Bitcoin fees, showing how important it was to the economy as a whole. Recent numbers, on the other hand, show that Runes’ market share has dropped to just 21.1%, while other fees now have 78.9% of the market.

This slowdown is bad news for miners who used to make a lot of currency by making new rune units and creating new ones. This is especially true now that rewards have been cut in half. Analysts say that miners could lose a lot of currency if action on the protocol doesn’t pick up again.

Mining companies’ earnings dropped sharply from 1677.09 BTC on April 20 to 533.69 BTC on May 11. This is supported by data from Glassnode. The drop in action on the Runes protocol is very similar to this drop.Runes’ decline affects more than just its environment. As a whole, it means that there is less activity on the Bitcoin network.

Also becoming less common are Bitcoin Ordinals and BRC-20 tokens, such as those made with the Taproot update. One example is that the price of ORDI, which is the largest BRC-20 token by market cap, dropped by a remarkable 61.88%.People are ten times less interested in these tokens now that their value has dropped from over $6 billion in December 2023 to just $628 million today.