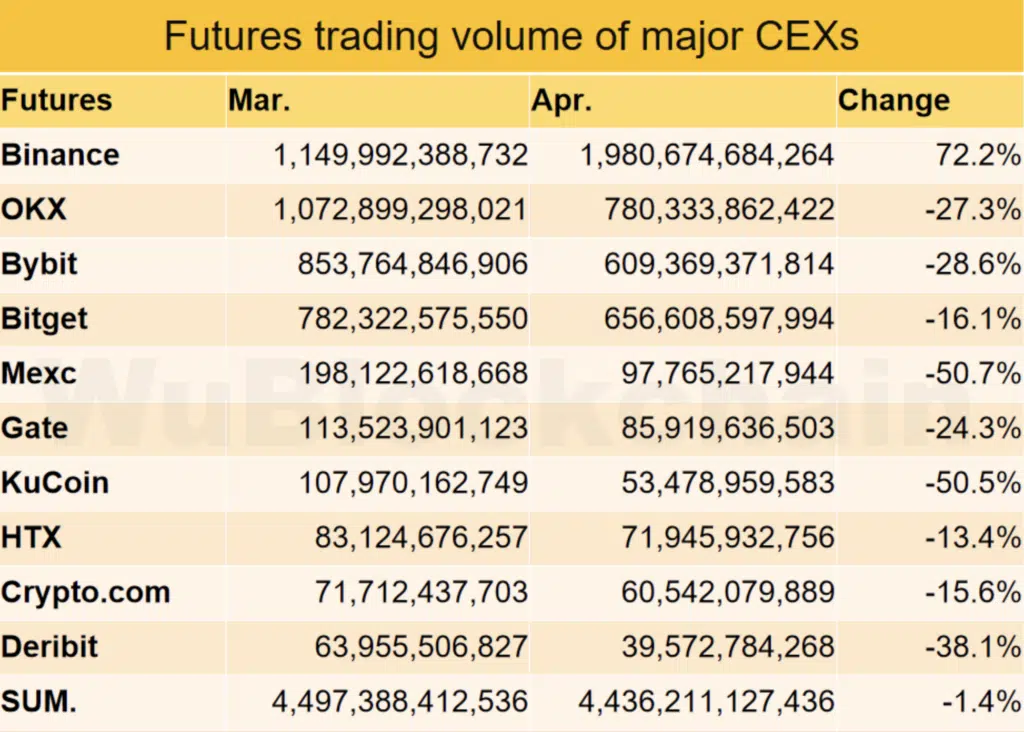

Overall, major exchanges’ trading numbers went down in April, but Binance, the biggest centralized exchange (CEX) in the world, saw a huge increase in futures trading volume—up over 72% from March to April.

The number of derivatives trades on the world’s biggest markets decreased by 1.4% month-over-month. However, Binance went against this trend by seeing a huge increase in futures trading. This was because they introduced a time-limited fee discount for USDC permanent contracts.

Binance’s Trading Volume Boosted by Perpetual Contracts Promotion

The Wu Blockchain team said this promotion led to a big rise in trading for perpetual contracts, which helped Binance’s trading volume grow quickly this month.

However, if you take out this particular offer, the total trading volume on Binance dropped by 26.6% compared to the previous month. The number of futures trades on other major platforms also went down. Bitget, Crypto.com, and HTX saw big drops of 16.1%, 15.6%, and 13.4%, respectively.

The number of spot trades fell even more sharply, by almost 38% month-over-month. One place where action did not go up was Gate, which went up 13.7%. On the other hand, Kucoin, Upbit, and Bitfinex all saw big drops, with 70.8%, 57.5%, and 47.7% drops, respectively.

The rise in trading on Binance happened at the same time that all USDC-margined perpetual contracts got a discount on their trading fees in early April. This marketing campaign began soon after Changpeng Zhao, the founder of Binance, was in trouble with the law. He was given a four-month jail sentence, and the exchange was fined $4.4 billion for breaking the Bank Secrecy Act.

Zhao quit as CEO of Exchange and agreed to pay a $50 million fine after he admitted guilt and made a deal with the police. Despite these problems, Binance’s smart promotions and wide range of trading options have clearly kept its trading rates high even when the market as a whole has been down.