Ethereum (ETH) and Bitcoin (BTC) get close to ending on May 17, the cryptocurrency market is likely to see significant fluctuations. A well-known derivatives market called Deribit says that today is the last day for Ethereum contracts worth $950 million and Bitcoin options worth a total of $1.18 billion.

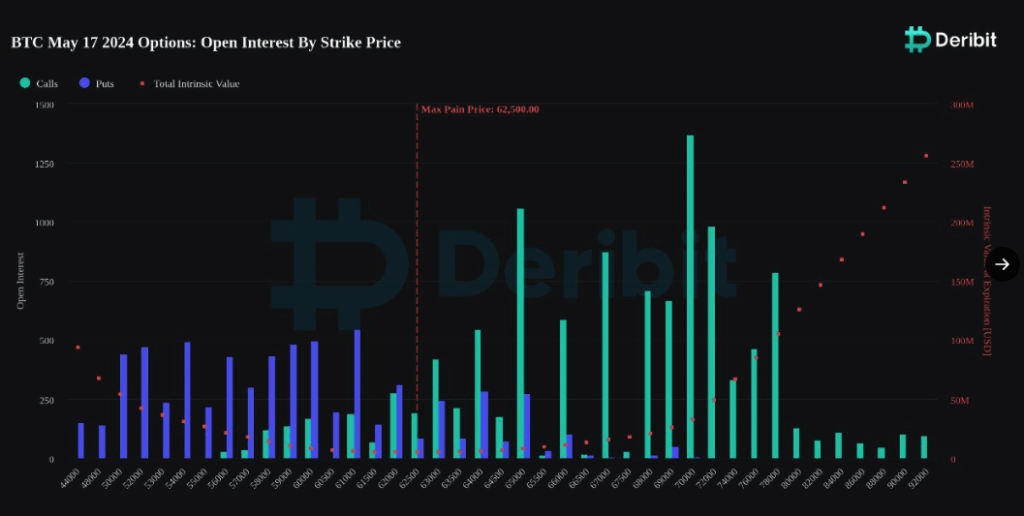

The put/call ratio for Bitcoin was 0.61 at press time, and the price at which it would fall the most was set at $62,500. This ratio, which is a very important sign in options dealing, shows that traders are mostly neutral, with about the same number of bearish and bullish positions.

On the other hand, Ethereum’s Put/Call Ratio was much lower at 0.21, which showed that buyers were mostly bullish. The most that Ethereum could lose was set at $3,000.

Ethereum’s Bullish Sentiment

When trading options, a “put” option is a bet that the price of an object will go down, and a “call” option is a bet that the price will go up. More puts are being bought than calls when the Put/Call Ratio is above 0.70. This usually means that people are negative. A bullish mood is shown by a number below 0.50.

So, Bitcoin’s ratio shows that the market is almost balanced, while Ethereum’s low ratio shows that buyers are expecting prices to go up.As of this morning, Bitcoin was selling at $66,443, which is well above its highest point of pain. This means that traders probably won’t have to deal with a lot of financial trouble.

But Ethereum’s price was dangerously close to its worst point when it was selling at $3,018, which means that traders could lose currency if the price falls below $3,000 by the end of the day.

A lot of market experts, including those at Greeks.live, have said something about it. Their analysis, pointing out that people have mixed feelings about Bitcoin and a worsening future for ETH because of problems with market confidence.

Greeks.live said on X (formerly Twitter), “BTC is more balanced between long and short, while the ETH price is weak, which is causing market confidence to continue to drop, and selling calls have become the only thing that matters.”Even though the market is down right now, there is hope for Ethereum’s future.

Deribit data shows that between the last week of May and the beginning of June, there were more bets that Ethereum would reach $3,600. Part of this confidence comes from waiting for the U.S. Securities and Exchange Commission (SEC) to make a decision on several Ethereum ETF applications.