Bitcoin (BTC) surprised investors last week with a significant double-digit rise, which made the cryptocurrency market very exciting. The rise has given people hope that BTC will soon be able to reach $70,000 again.

CoinMarketCap says that Bitcoin’s price has gone up more than 10% in the last week, putting it above $67,000. BTC was worth more than $1.32 trillion at the time of this writing and was selling at $67,115.81.

Analysts in the market are paying attention to the price movement that is going up. Titan of Crypto, a well-known crypto expert, recently brought attention to an interesting trend on Twitter.The tweet says that Bitcoin is aiming for the top limit of its realized price. This means that BTC might go over $100,000 in the next few weeks. Bitcoin has hit the upper line of its realized price in every previous market cycle, which supports this idea.

Bitcoin Market Peak Possible

On-chain measures are another reason to be optimistic about Bitcoin’s future. Using data from CryptoQuant, Analyst found that BTC’s net deposits on platforms were going down, which means there isn’t much selling pressure.

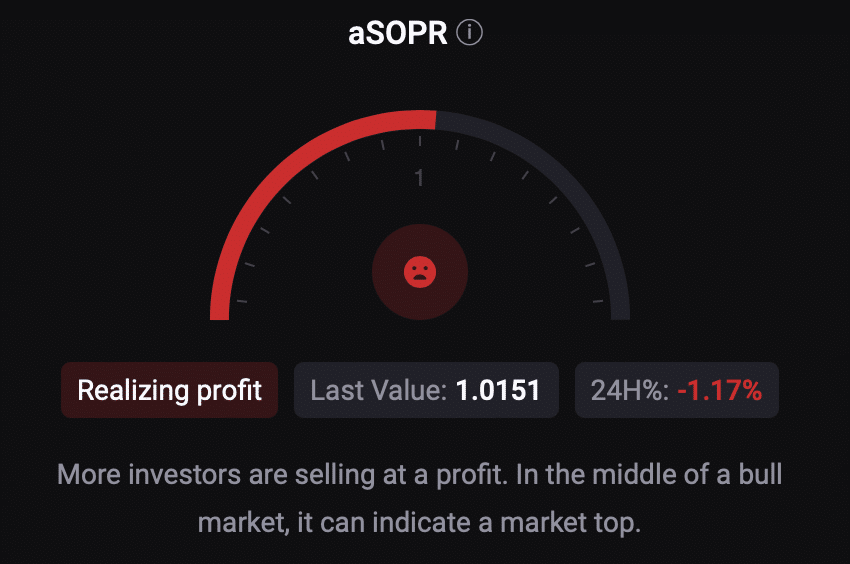

Bitcoin’s Miner’s Position Index (MPI) was also in the green, which means that miners are selling fewer shares than they did a year ago. But BTC’s Adjusted Spent Output Profit Ratio (aSORP) was red, which means that a lot of buyers are selling at a profit right now. This can mean a market peak during a bull market.

Even though there are some good signs, other measures make us more cautious. Analyst looked at data from Glassnode and found that Bitcoin’s growth trend score was 0.0107. This number shows how many entities are actively accumulating coins on the blockchain. A value closer to zero means investors are either distributing BTC or not doing so.

The Fear and Greed Index for BTC also showed a value of 72, which means the market is in a “greed” phase. This usually happens before price drops. BTC was testing its resistance at $67,300 at press time, according to Analyst’s study of BTC’s daily chart. It was also above its 20-day Exponential Moving Average (EMA).

The Relative Strength Index (RSI) also showed an upward trend, which means Bitcoin might move from its resistance to its support, keeping the short-term view bullish. The Chaikin Money Flow (CMF) sign, on the other hand, was pointing down, which suggested that prices might be going to correct themselves soon.