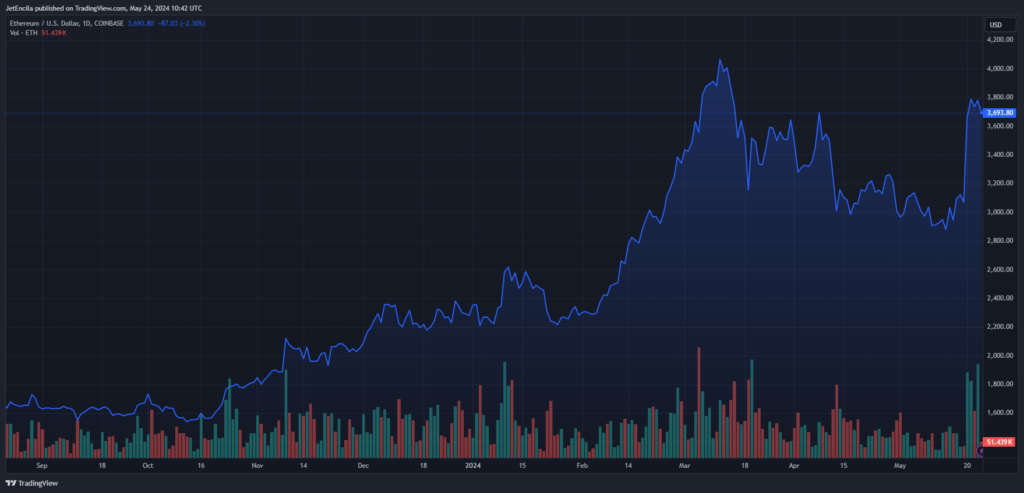

New events have caused the price of Ethereum (ETH), the second-largest cryptocurrency in the world, to rise sharply, which suggests it could go back to $4,000 soon. The trend is thought to be going up because a lot of people are buying, especially in the futures market.

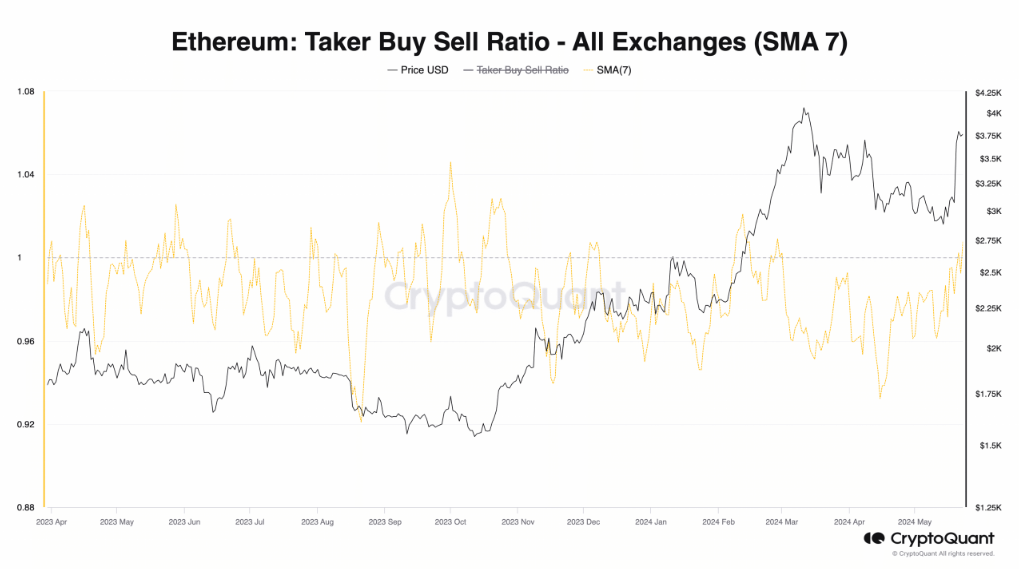

It shows how many buy orders there are compared to sell orders in ETH’s continuous futures market. This is an important measure that is being looked at. In the past, when the number was above 1, it meant that there were more buy orders than sell orders. This made people feel good.

The market felt better when it was reported that the US SEC had cleared spot Ethereum ETFs. Most people had thought that they would be turned down. Because of this, the price of Ethereum has been going up and down. Late Thursday trade made this very clear.

Ethereum’s $3,770 Amid Bullish

The price of Ethereum is around $3,770 right now, which is a lot more than its recent low of $3,500 but less than its previous highs of over $4,000.

According to new research by CryptoQuant, Ethereum’s Taker Buy Sell Ratio is getting close to crossing above the 1-center line. This is based on a 7-day simple moving average. This could mean less pressure to sell and more interest in buying, which could mean a return to the $4,000 price level.

Analyst at CryptoQuant ShayanBTC stresses how important it is that the Taker Buy Sell Ratio has gone up. He says that the market may change as strong selling pressure goes down, which could be good for the price of ETH.

The open interest in futures, which shows how many open futures contracts there are, supports the bullish view. Coinglass, a crypto analytics tool, says that the open interest in ETH futures has hit a record high of $16 billion. This means that more people are investing and are optimistic about the market.

The fact that Open Interest is at an all-time high shows that buyers are much more sure of themselves. It’s possible that this is because more businesses are using ETH and everyone is excited about Ethereum 2.0.