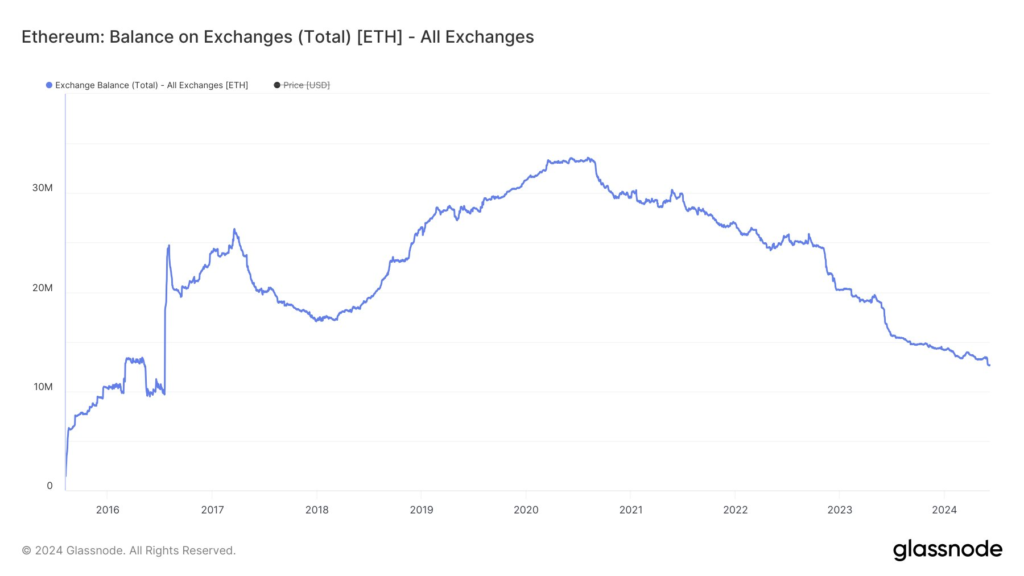

Ethereum ( ETH) is likely to undergo a major market revolution with its holdings on exchanges at their lowest point in eight years.

This decline in supply lines aligns with the projected release of spot Exchange Traded Funds (ETFs), which will draw significant investor interest and might cause a significant price increase.

Spot ETFs could cause an initial rush to acquire Ether, hence increasing prices. Corrections, though, could follow this increase as the market adjusts to fresh supply and demand factors.Ethereum’s price is currently heading down and falls below the moving averages for both 50- and 200-period.

Ethereum Transactions Indicate Bullishness

Usually speaking, this alignment points to a pessimistic market attitude. Often preceding a market rebound, the Relative Strength Index (RSI) is at 43, suggesting a possible further decrease before reaching oversold criteria.

The market stays basically solid in spite of the bearish technical signals. Reflecting a strong market, a remarkable 89% of Ethereum holders are now in profit. Furthermore, Ethereum’s ownership is quite skewed—whales hold 51% of it. Depending on the behavior of a rather limited number of wallets, this concentration can cause notable price swings.

With a total of $32.81 billion in activity last week, high-value transactions above $100,000 each have been rather plentiful. This points to significant participation from institutional or large-scale investors, so reflecting positive attitude among important players in the market.

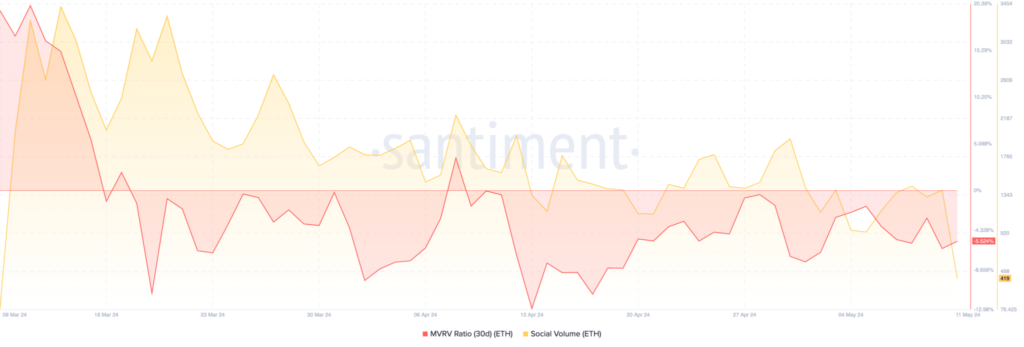

Recent declining patterns in the Market Value to Realized Value (MVRV) ratio point to Ethereum approaching a zone of lowered overvaluation. This cooling-off period might be a beneficial market correction, so laying a more solid basis for a possible bull run.

Ethereum’s price has to remain above the current support level at $3,670 if it is to start a notable increasing path. A successful breach of the $3,733 resistance might drive the price toward the psychological barrier of $3,800.