Ethereum (ETH), with its second-largest market capitalization, presents different picture for investors. Significant investors, commonly referred to as “whales,” are increasing their ETH holdings even with a recent price drop according on-chain data.

Technical indicators imply a weakening uptrend, which raises worries about Ethereum’s near-term future even if it could point to a prospective buying opportunity.

Wallets containing more than 10,000 ETH have been gradually accumulating more tokens since May’s end. Glassnode says that this accumulated period corresponds with Ethereum’s price reduction from about $3,074 to its current level of $3,670. The significant increase in holdings of these major shareholders indicates they view the price decline as a great basis for predicted future returns.

Further bolstering a positive view, CryptoQuant’s Netflow data for ETH reveals a predominance of negative flows in recent weeks, so more ETH is leaving exchanges than entering.

Ethereum’s Uncertain Future Ahead

This tendency implies that rather than selling, investors are hanging onto their ETH, therefore lowering the supply of the market and maybe raising prices over time.

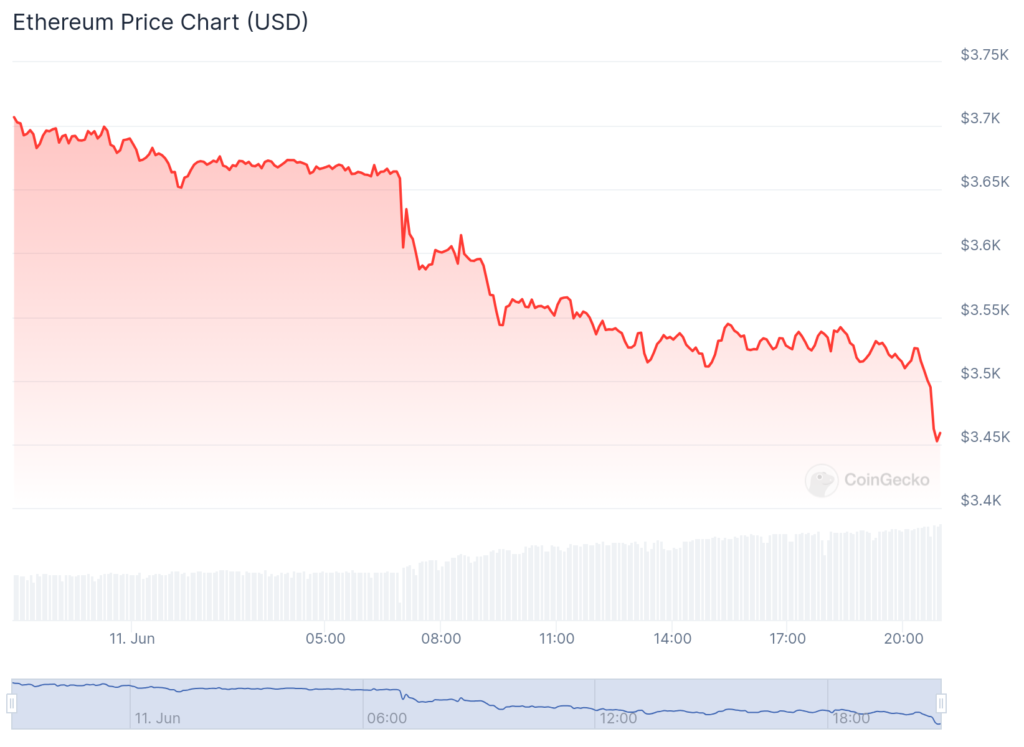

Technical signs offer a less hopeful picture, nevertheless. For the previous three days Ethereum has been trading in a limited range around $3,600; today it has slightly dropped 0.8%. Though it is now on a declining path, the Relative Strength Index (RSI) stays above 50, suggesting a little uptick. Should this persist and the RSI approach the neutral line, it could indicate a possible price downturn.

The negative RSI trend suggests deteriorating momentum, which should not be stopped since it can lead to greater price declines. Investors find this bearish technical perspective challenging since it runs against the positive on-chain data.

The near term future of Ethereum rests on a significant event. wider general market attitude or specific Ethereum network developments like successful upgrades or wider acceptance of distributed apps (dApps) could stimulate investor interest and raise prices.