The U.S. Securities and Exchange Commission has started legal action against Consensys, an Ethereum developer, saying that it is running an unlicensed securities exchange through Metamask.

According to the SEC’s case, Consensys did not register as a broker, which meant that investors did not get important protections. The agency says that staking programs like Rocket Pool and Lido are stocks because they involve small investments in a group project that aims at generating funds.

SEC Targets MetaMask Operations

The SEC is targeting Consensys’ MetaMask Staking tool because it does business in Lido and Rocket Pool contracts for other people, which the SEC says is like an exchange. It is said that Consensys finds investors, helps with business deals, and gives tips on which investments to make.

The Securities and Exchange Commission also says that stocks that have not yet been listed include Polygon (MATIC), Chiliz (CHZ), and other tokens. The case comes after the SEC ended its investigation into Ethereum 2.0. Developers saw this as a victory.

However, Consensys points out that it is still hard to set up a regulatory framework that supports developers.

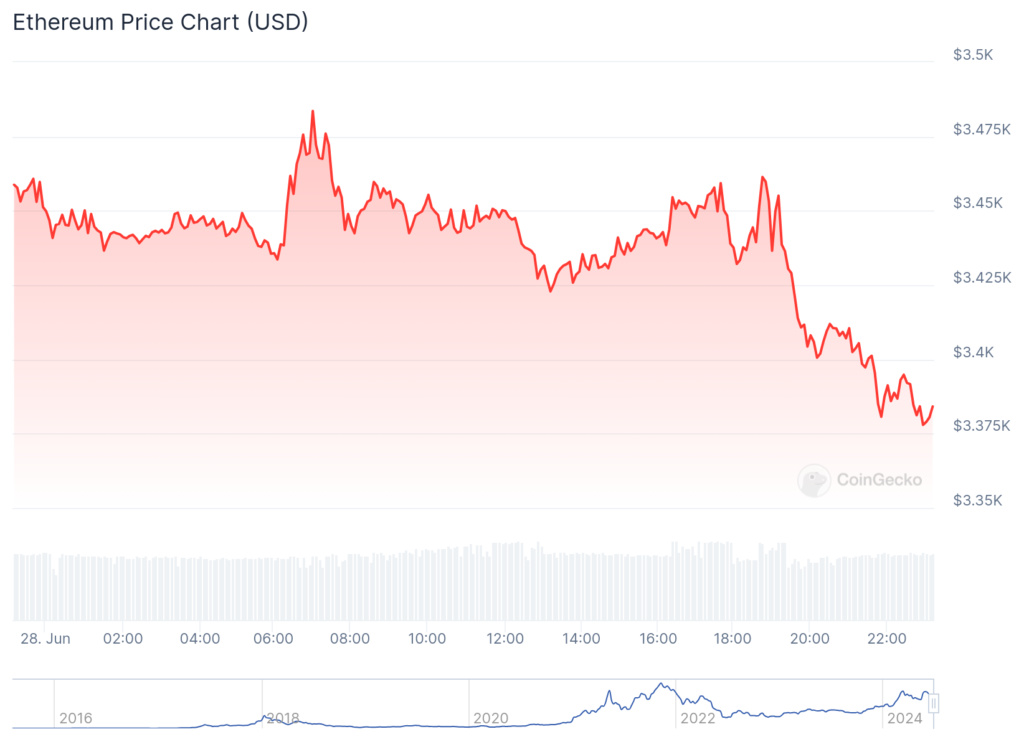

In early April, Consensys sued the Securities and Exchange Commission ahead of time to avoid possible cases over MetaMask Swaps or Staking. CoinGecko says that Ethereum’s market price has gone down by 2% in the last 24 hours.