Cryptocurrency analytics company IntoTheBlock says that Bitcoin whales have been buying the BTC aggressively since it dropped below $60,000, which shows that major holders are putting an excessive amount of pressure on the price to go up.

Wallets that hold more than 0.1 percent of all Bitcoins got about 55,000 BTC in net flows in the last month.

A crypto analyst named Ali said earlier today that there are “early signs” of BTC accumulation, which means that after three months of release, there may be an accumulation phase.

Bitcoin’s Sideways Opportunity Emerges

CryptoQuant’s Ki Young Ju also said that Bitcoin’s sideways price action could be an excellent opportunity for buyers to buy, saying that the cryptocurrency is still going up even though the market is feeling bad.

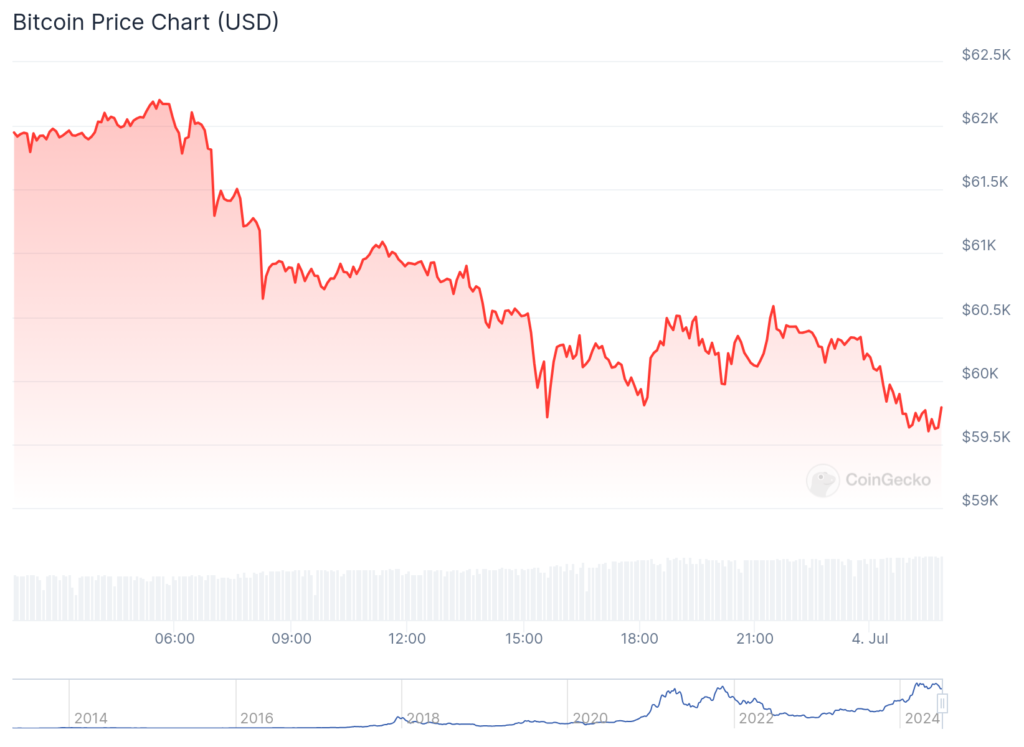

BTC fell to an intraday low of $59,712 on Wednesday. This made prominent skeptic Peter Schiff expect an additional drop. However, bulls seem determined to keep the important $60,000 mark. According to CoinGecko, BTC is currently trading at $60,373.

Lookonchain, an analytics company, saw that the recent drop in price happened at the same time when significant whale deposits hit the Binance exchange.

Tom Lee of Fundstrat said earlier this week that he thought Bitcoin’s price could reach $150,000 by the end of the year.