Cardano [ADA]’s price chart has been going down steadily since mid-April, and bearish predictions have been the norm for the longer periods. The drop started when the support level at $0.56 was lost, and it has only gotten stronger since then.

In the second half of June, bears made their intentions clear again, which kept ADA’s price dangerously close to its low point of $0.4 in mid-April.

Investors are worried that the price might be going down even more because it can’t hold this level as support. What do buyers want to get next? That is the important question right now.

Cardano’s Bearish RSI Trend

From December 2023 to May 2024, Cardano was in a band that was broken. Since then, it has turned into resistance. The next goal for bears is the 23.6% extension level, which lines up with the $0.3 support level. This is based on Fibonacci levels that were drawn during the March price drop.

Technical indicators for the daily period show a bad picture. The RSI recently tried to break through the neutral 50 mark but was stopped, which made the downward trend stronger.

Additionally, the On-Balance Volume (OBV) has been steadily falling, showing that there is a lot of selling pressure and not much buying. It’s more possible that ADA prices will move toward $0.3 in the near future because of these factors.

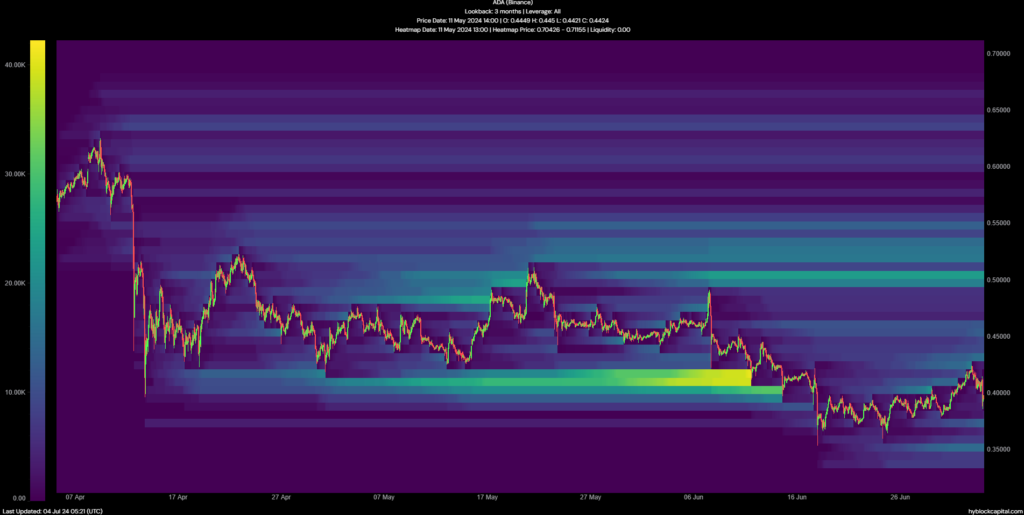

Early in June, the $0.4–$0.415 range was a key area of liquidity, with a wide range of amounts of liquidation. But this area was tried as support and gave way to the selling pressure in the end. It has been fighting for ten days now.

The bankruptcy heatmap also shows that there is some extra money building up at $0.427, which is just above the recent high. The $0.35 level also looks like an interesting area to watch in the short run.

There’s a chance that the price of Cardano could go back and forth between $0.42 and $0.37, making it easier to buy and sell above these levels before possibly selling them in the coming weeks.

As long as the downward trend stays in place, investors should be careful and keep a close eye on these important marks. The next steps for ADA will depend a lot on how the market moves in the next few days.