Bitcoin, which is without a doubt the most popular cryptocurrency, is at a very important point. After a great first half of 2024, when it soared past the $71,000 mark, Bitcoin has dropped and is now circling around the important $61,000 support zone.

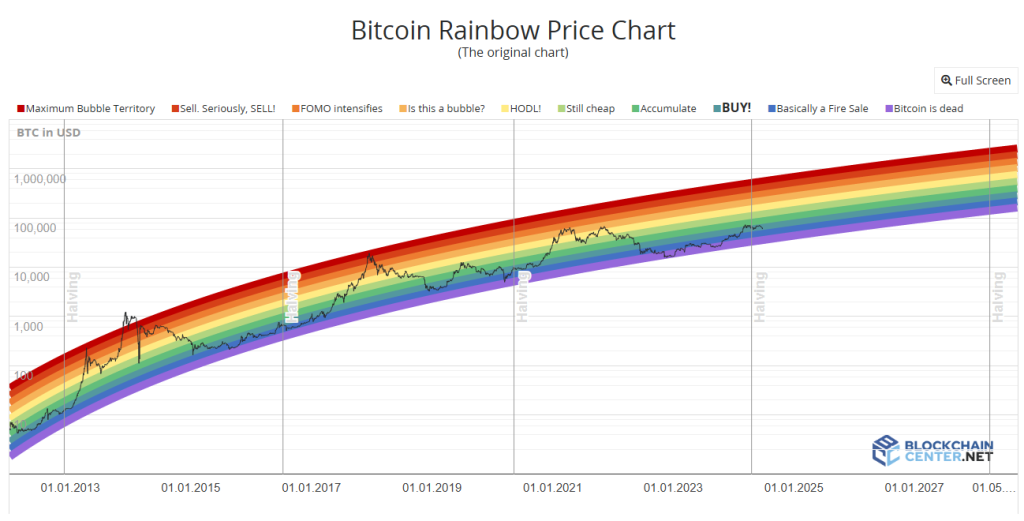

Analysts are divided on how to respond to the recent drop in prices. Some are still optimistic about the long term, while others are warning of possible problems ahead.The Bitcoin Rainbow Chart, a well-known tool that looks at price changes on a logarithmic scale, is a big reason why some bears are optimistic.

This chart shows that Bitcoin is currently in the “Buy” zone, which means it has a lot of room to grow before it reaches its peak. Price cycles in the past, especially those that happened after halving events (when the prize for mining Bitcoins is cut in half), point to September or October 2025 as a possible high point. Some analysts think this could mean a price goal of at least $260,000.

Bitcoin Faces Market Volatility

The Rainbow Chart’s predictions don’t work for everyone, though. Some people disagree with the picture because it only shows what happened in the past and not what will happen in the future. Concerns have also been made by the recent drop in the “Coinbase Premium Index.”

This index checks the price difference between Bitcoin traded on Coinbase in the US and other markets around the world. It is currently negative, which means that US investors, who are a very important market group, are losing interest.

Adding to the care is the fact that investors are afraid and hesitant right now. Recent drops in prices have made people less sure of themselves, so many are taking a “wait and see” attitude. This feeling is shown by the sharp drop in “Open Interest,” a measure of the total value of futures contracts that are still open.

Since Bitcoin prices have been falling recently, investors are not willing to take long positions in the currency. As a result, Open Interest has dropped greatly, which could mean that fewer people are participating in the market.

Even so, some analysts see this drop as an inevitable correction. They say that booms can’t last if the futures market gets too hot because of too much debt. They think that the current drop is getting rid of players with too much debt, which will allow Bitcoin to grow in a more stable way over the long run.

Bitcoin’s future is still unknown. Based on past trends and the Rainbow Chart, there is a lot of room for growth. However, short-term investor sentiment and falling US market participation are two things that can’t be ignored. The next few months will be very important in figuring out whether Bitcoin can get through the problems it is facing now and start rising again, or if it will give in to bearish forces and fall.