Binance Coin (BNB) has quickly gone up quite significantly from its support line in the shape of a symmetrical triangle. This has investors and the market very excited. It means that the price is being pushed between buyers and sellers during a consolidation phase when lower highs and higher lows line up like this.

The most recent market report says that BNB is worth $583.84, which is 3% more than the $566 amount that it used to be worth. We are curious about whether BNB can keep going strong and break through the symmetrical triangle’s upper trend line. Prices might go up a great deal if it does.

Binance Coin Momentum Indicators

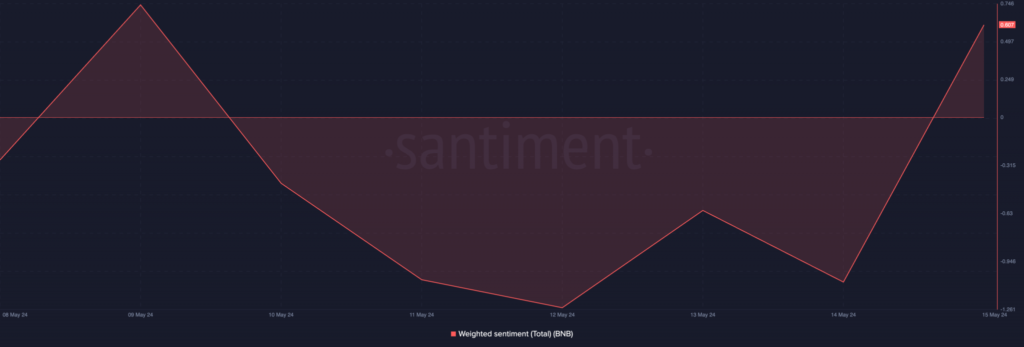

A key indicator of how prices will move in the future is how the market feels right now. Right now, the mood is good for BNB. As per Santiment data, the happiness score is 0.607, which means things are getting better. In the market, this means that people like Binance Coin. This could mean that prices will rise even more.

BNB’s key momentum indicators back up this bullish view. The Money Flow Index (MFI) is rising and now stands at 65.61. This means that buyers are buying more BNB instead of selling it. Also, the Chaikin Money Flow (CMF) is going up and is now above zero at 0.07, which means that money is steadily coming into the BNB market.

This steady rise in the CMF could mean that more people want to buy the coin.If things keep going in a good direction, BNB’s price could go above the triangle’s support line. The next goals could be $596 and then $643. It’s possible for the positive story to fall apart, though, and BNB’s price could drop to around $520.

The new funding rate trends at Binance Coin are significant shifts that could make this situation different. It is said by Coinglass that BNB’s funding rates have been mostly negative since April 23. At 0.106% on May 15, they were the lowest they had been in more than a month.

Being short means that traders think prices will go down, and this negative funding rate shows that there are a lot of them. The last time the funding rate was this low was in February. This shows that there may be some problems with BNB’s recent rise.