Bhutan’s Druk Holding and Investments (DHI) and mining company Bitdeer are going to significantly boost their Bitcoin mining capacity. This is part of a plan to reduce the possible losses that could come after Bitcoin is cut in half.

DHI, the sovereign financial arm of the Kingdom of Bhutan, and Bitdeer Technologies, a Nasdaq-listed company, have both said they want to sixfold their BTC mining power before the expected halving event.

Bitcoin Mining Boost In Bhutan

Reports say that the goal of this project is to make up for the fact that mining awards will be halved soon. Bitdeer’s chief business officer said that the planned upgrades will boost Bhutan’s mining power by an amazing 500 megawatts. The upgrades are expected to be finished by the first half of 2025, giving the kingdom a total mining power of 600 megawatts.

The increase will be paid for by a $500 million fund that the two organizations set up, as they said on May 3, 2023. Jihan Wu, the chairman of Bitdeer, said that the company was committed to using Bhutan’s clean energy resources to support blockchain technologies. They also want to build foreign partnerships that will help Bhutan’s tech industry.

Bhutan’s DHI, which manages more than $2.9 billion in assets, was found to have already built up a crypto portfolio. This was discovered during the bankruptcy processes of Celsius and BlockFi, where DHI was identified as a major customer.

Reports also report that Bhutan has been mining BTC with its many electricity resources since 2019, when the price of Bitcoin was around $5,000.

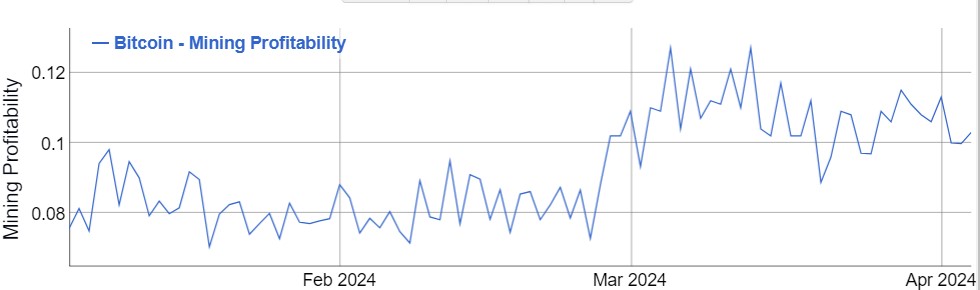

While DHI and Bitdeer prepare to fight any loses that might happen after the halving, experts have various opinions about how it will affect their profits. CEO of Acheron Trading Laurent Benayoun says that if mining awards go down, network fees could go up to make up for it. Jimmy Zhao, a senior solution engineer at BNB Chain, also suggests that BTC-based nonfungible tokens could help miners make more money after the halving.

As of February 2024, crypto asset manager Grayscale thought that Bitcoin transactions brought in more than $200 million in fees for miners. This shows how the crypto mining market is always changing.