- The Fed may cut rates early if geopolitical or trade tensions escalate, potentially boosting Bitcoin.

- Bitcoin remains highly correlated with tech stocks, benefiting from investor appetite for high-risk assets.

- A weaker U.S. dollar and falling yields could drive Bitcoin past $120,000 as demand for inflation hedges rises.

U.S. Federal Reserve can be forced to lower interest rates prematurely in case the geopolitical tensions between the two countries and Iran intensify, or the trade talks fail repeatedly. Even though markets largely expected the central bank to leave its benchmark interest rate on hold at 4.25% in its Wednesday policy meeting, it retained the option of acting earlier in case of any crippling interferences before its next normal policy meeting on July 30.

Fed Governor Christopher Waller on Friday telegraphed a change in message, saying in an interview with CNBC that the Fed should consider cutting rates as soon as this month, citing a decline in inflationary pressure and no immediate risks to the economy.

Although the likelihood of this rate cut is not very large, analysts are evaluating possible consequences of this action on Bitcoin (BTC) and other risky assets, especially adopting the overall shift in the approach of the Fed towards being cautious.

Middle East Tensions and Trade Risks Loom Large

In the past, major shocks including geopolitical shocks, financial shocks as well as health shocks have usually been triggers to emergency rate cuts. The previous such action was performed in March 2020 when Fed reduced the rates by 100 basis points due to outbreak of COVID-19.

When this was announced, markets rattled with gold closing at a seven-month low and dramatic investor panic ensuing. However, markets soon pulled out; the S&P 500 rallied by late May 2020, and the Bitcoin fell back to credit $8,800 by late April.

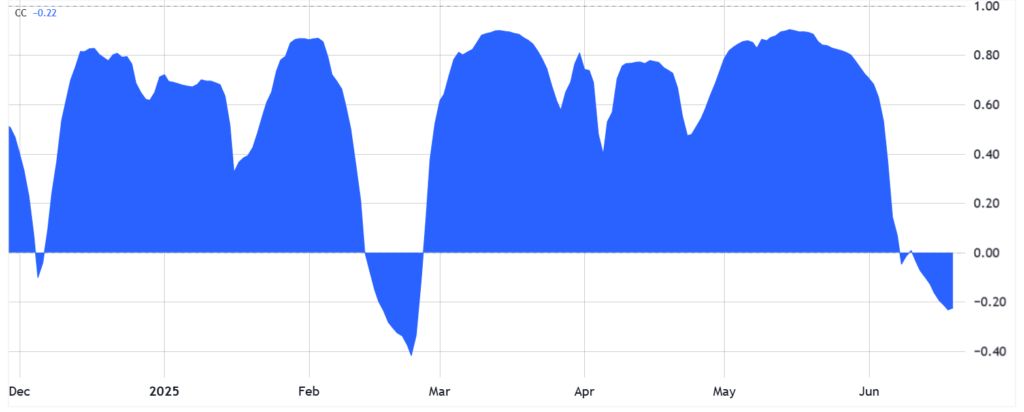

In the current production, Bitcoin is still traded along with the technology stocks as investors are interested in high-risk and high-return asset values. In the March-May period of 2025, it showed a 30-day connection of over 70% with the Nasdaq 100 index.

Any further turmoil in the Middle East, especially in the Strait of Hormuz that moves about a fifth of the world oil and gas supply, may increase energy prices and reduce economic growth, which will subsequently help to undermine inflation expectations and open the gates to loosening the policy. Meanwhile, unsettled trade conflicts are another vulnerability factor. In the event that the temporary tariffs ceasefire with China collapses or allies like Canada or the EU become less cooperative in the negotiations, the ensuing export pullback is likely to cause the Fed to start taking interest rate cuts to encourage domestic lending and investment.

Dollar Weakness May Boost Bitcoin Demand

Even though there is no direct connection of rising of interest rates to rise of national debt, it makes it costly to practice refinancing. U.S. Treasury bonds with a maturity of 20 years have climbed to 4.9% in recent months, 4.6 before, as investors remained doubtful of the country issuing to curb the inflation rate and demanded a higher yield premium.

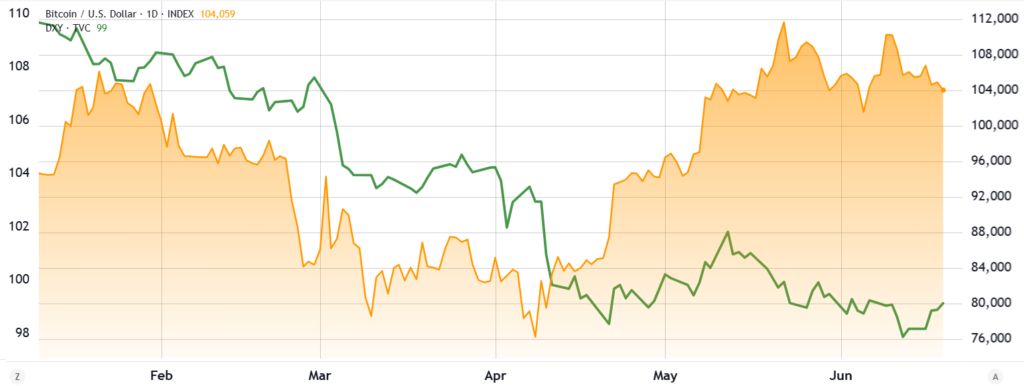

At the same time, U.S. Dollar Index (DXY) is currently at 99 and is close to its three-year low, 104 in March. Additional dollar weakness may occur in the event of a sudden rate cut which will be perceived by markets as a precursor of recession. In this situation, the need in the inflation-resistant assets, such as Bitcoin, may grow significantly, causing the BTC price rise even above the mark of $120,000.