As of August 19, SoSoValue data indicates that the top 12 Bitcoin exchange-traded funds (ETFs) in the US had added $61.98 million. That same day, net imports came at $36.01 million, a 72% increase. As the market for cryptocurrencies is improving, the increase in inflows indicates that investors are once more drawn to Bitcoin.

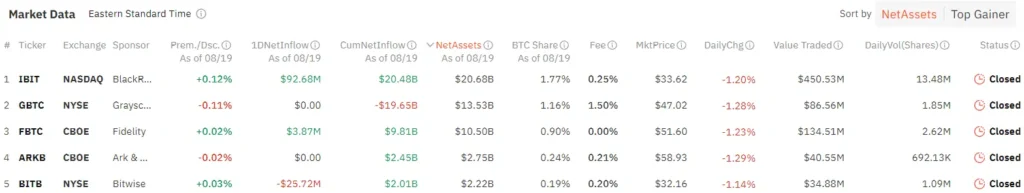

BlackRock’s IBIT had the most inflows, with a healthy $92.7 million. This brought its overall inflows since its start to $20.48 billion. FBTC from Fidelity came in second with $3.9 million in new money. These two Bitcoin ETFs were the only ones to see new money come in for two days.

Still, not every Bitcoin ETF had gains. On the same day, net withdrawals from Bitwise’s BITB and Invesco Galaxy’s BTCO were $25.7 million and $8.8 million, respectively, somewhat negating the gains from other funds.

There were no inflows or outflows on Grayscale’s GBTC, which is a first since the platform’s founding. Since its inception, the GBTC fund has continuously lost capital, with cumulative withdrawals totaling $19.64 billion.

As investors anticipated possible declines, seven other Bitcoin ETFs were neutral and saw no notable inflows or outflows. Despite recent market volatility, spot Bitcoin ETF inflows have now exceeded $17.4 billion, demonstrating robust investor confidence.

Bitcoin’s Rise Contrasts Ether ETFs’ Continued Outflows Amid Market Struggles

Ether ETFs, on the other hand, had yet another difficult day. On August 19, the nine Ethereum ETFs had withdrawals totaling $13.52 million, the third day in a row of withdrawals. With a $20.3 million loss, Grayscale’s ETHE was the most liquid, contributing to a $2.43 billion outflow since its launch.

Not all Ether ETFs, though, were losing money. The outliers were Bitwise’s ETHW and Grayscale Bitcoin Mini Trust, which reported meager inflows of $1.9 million and $4.9 million, respectively.

The lack of activity in the remaining six Ethereum ETFs indicates investors’ reluctance to commit to new ether-based products.

With only $124 million in trades, Ether ETF trading volumes fell dramatically from $185 million on the previous trading day. Overall, there has already been a $433.62 million net outflow from these funds.

Even with the continuous withdrawals, Ethereum experienced a slight price increase, up 2.3% to $2,673. The worldwide cryptocurrency market capitalization increased by 2.4% in the last day to reach $2.24 trillion, reflecting the increasing trend in the market. This growth is consistent with this trend. Bitcoin was trading at $60,937, up 4.2% at the time of writing.