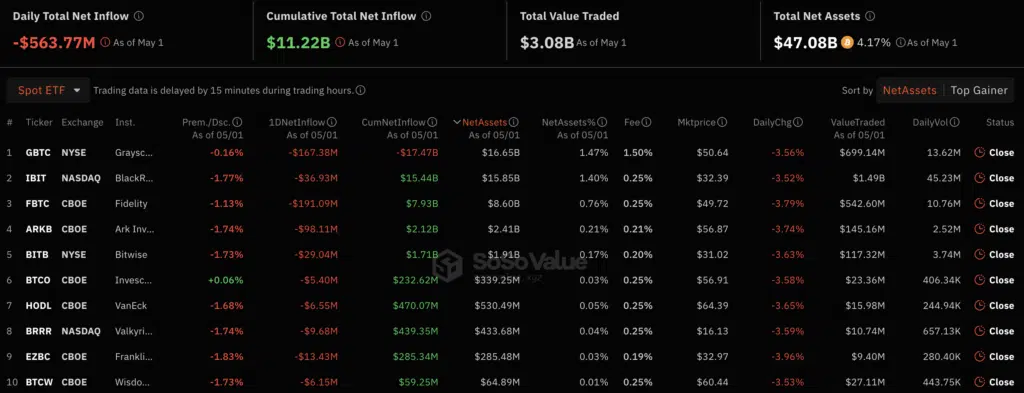

This type of exchange-traded fund (ETF) in the U.S. lost much money. It reached a high point of $563.77 million on May 1.

A report from SoSo Value showed that today was the sixth-day money was leaving the sector. Most funds have been leaving the market since May 1, when the U.S. Securities and Exchange Commission (SEC) approved spot Bitcoin ETFs.

Bitcoin ETFs Witness Massive Outflows, Fidelity Fund Hit Hardest

The funds invested in ten ETFs were taken out. The Fidelity Wise Origin Bitcoin Fund (FBTC) lost the most money, with a huge $191.09 million going out of its account.

On May 1, the first funds left the iShares Bitcoin Trust (IBIT), which BlackRock ran. The fund had a yearly for 70 days before this.

The ETF Store’s Nate Geraci said IBIT succeeded like the iShares Gold ETFs. BlackRock makes the iShares Gold ETF. He said the second one lost over $1 billion in just one year.

An expert at Bloomberg Intelligence named James Seyffart agreed with this point of view. He said that ETFs usually work steadily and that changes are normal for these goods.

Should add — these ETFs are operating smoothly across the board. Inflows and outflows are part of the norm in the life of an ETF.

James Seyffart, Bloomberg Intelligence analyst

It took $345.88 million to lose funds in April, so on May 1, the net drain was more than that. It also dropped below $57,000 after news came out that Changpeng Zhao, the founder of Binance, would be going to jail for four months.

A lot of money is leaving U.S. spot Bitcoin ETFs, which shows how volatile and sensitive the cryptocurrency market is. Investors react quickly to new rules and price changes.