As the time gets closer to the expected $9.3 billion options expiration for Bitcoin and Ethereum, traders are getting ready for the crypto market to be volatile. Over 96,000 Bitcoin option contracts and an remarkable 978,000 Ethereum contracts are about to end, which means that prices could change a lot.

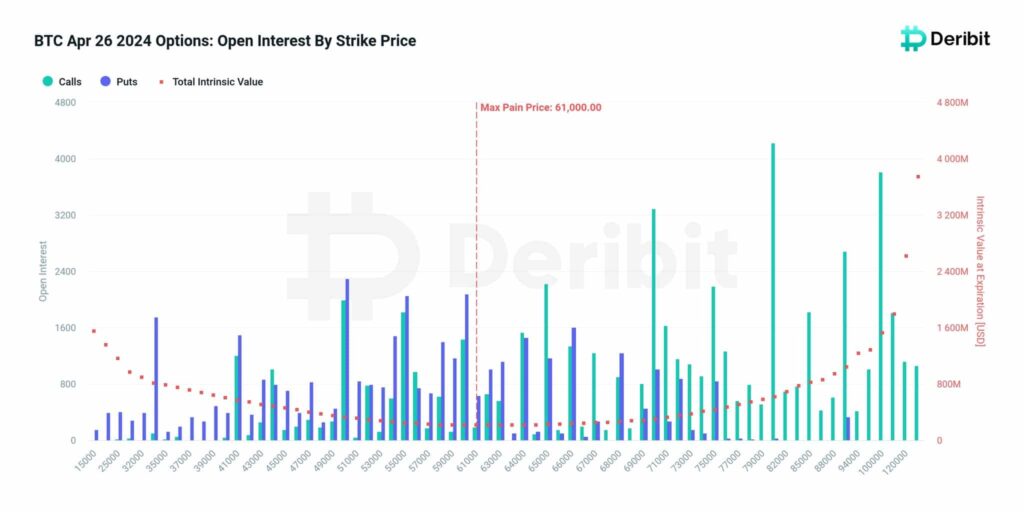

Exchange of derivatives Deribit shows how significant the upcoming expiration really is, BTC contracts are worth $6.2 billion and Ethereum contracts are worth $3.1 billion. As the expiration date gets closer, traders who own these options have to make important choices about whether to buy, sell, or close their accounts.

Bitcoin Traders’ Optimism Unfolds

Deribit’s analysis shows that Bitcoin traders are optimistic, as the BTC put-call ratio is moving in the wrong direction. On the other hand, Ethereum follows this trend, which shows that buyers are optimistic about price increases.

The expiration on Friday will have major effects, and who wins and loses will depend on where Bitcoin and Ethereum prices land. It seems that sellers will make the much currency if Bitcoin goes above $61,000, while buyers may lose money if Ethereum falls below $3,100.

Recent changes in prices have added another layer of doubt. Bitcoin is now worth about $64,140, which is 8.52% less than it was 30 days ago. Like BTC, Ethereum is now worth $3,129, which is a drop of 12.46% in the same time period.

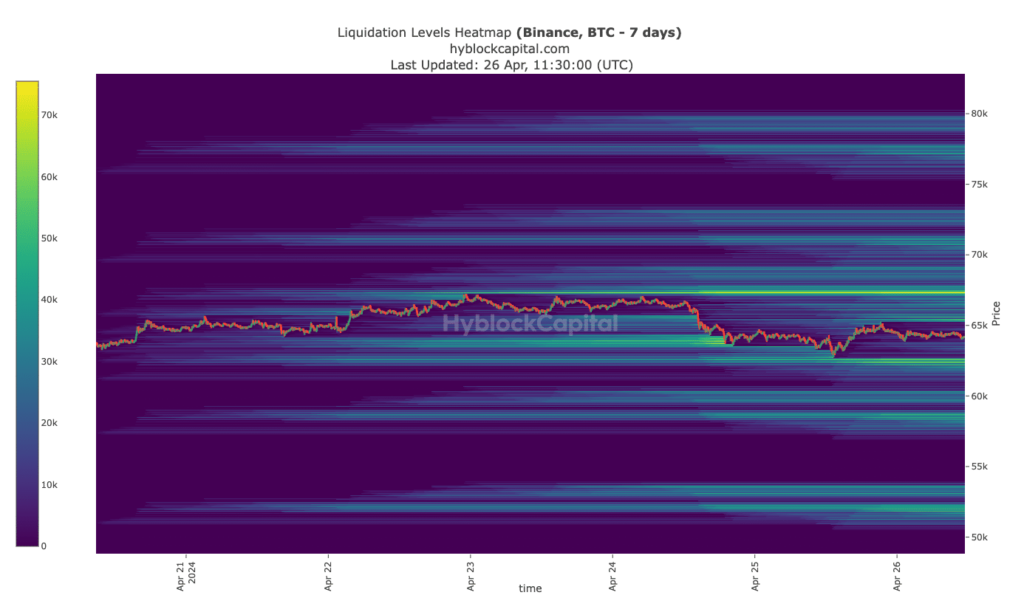

Looking at sale heatmaps can help you figure out how prices might move in the future. At $67,250, a magnetic zone forms for BTC, which points to a possible upward movement. On the other hand, if the price goes down toward $62,600, traders could lose money, though the losses will be smaller if the price stays above $61,000.

But things are different for people who trade Ethereum. Around $3,025, there is a lot of liquidity, which means that prices could drop below $3,100. Should this happen, a big chunk of the $3.1 billion in Ethereum options might be erased. However, if Ethereum stays above $3,100, people who own both call and put options may be able to play.