As the German government steps up its efforts to get rid of Bitcoin, the price has dropped again. Millions of dollars worth of Bitcoin have been sold by the government, which has had a major effect on the top cryptocurrency during a volatile market overall.

The constant drop in Bitcoin’s value has been caused by a number of things, such as money leaving Spot Bitcoin ETFs, bad market conditions, and Mt. Gox’s plans to redistribute BTC. The recent significant BTC sell-offs by the German government have put even more pressure on the price of the cryptocurrency.

Germany has been selling hundreds of millions of dollars worth of Bitcoins for weeks now. Arkham Intelligence, a blockchain analytics company, said on June 25 that the government sold 900 BTC, which is worth about $52 million. They sent 400 BTC to Coinbase and Kraken and the rest to an address that was not known.

Bitcoin strategic reserve suggested

Last week, the German government sold a lot of Bitcoin again, this time sending 3,000 Bitcoin worth about $172 million to different markets. The first 1,300 BTC were sent to Kraken, Bitstamp, and Coinbase. The rest were sent to a bank that was not known.

German cops sold an extra 2,738.7 BTC worth about $155.3 million on Monday, June 8. This was the most recent deal. Arkham Intelligence said it was likely that the Bitcoin was sold to Kraken, Cumberland, 139Po, and address bc1qu, which are all crypto exchanges or market makers.

There is still a lot of BTC held by the German government right now. Arkham’s data shows that the government has holdings worth 26,053 BTC, which is about $1.49 billion.

Even though there was a recent crash, the German government is still selling its Bitcoin holdings very quickly. A German Bundestag member named Joanna Cotar has said that she doesn’t agree with this approach. She says that the government shouldn’t sell BTC but should instead hold on to it strategically. She says that the current sell-offs are not helping and that the government should think about using BTC as a strategic backup currency.

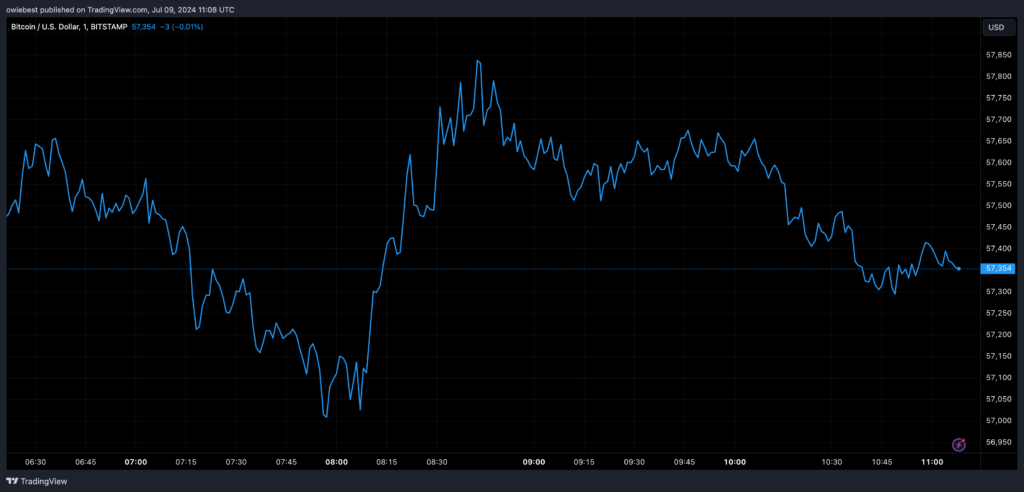

After going down 17.10% in the last month, BTC price has dropped by 8.71% in the last week. Long-lasting selling pressure and new bearish trends in the crypto market are to blame for this downward trend.

Since the starting point of June, BTC price changes have been very weak, significantly lagging. Even though money has been pouring into Spot Bitcoin ETFs, Bitcoin has stayed unstable below $60,000 and hasn’t shown much upward progress.

In an X post, crypto expert Ali Martinez said that BTC whales have sold over 30,000 BTC worth about $1.8 billion in the last month, on top of the sales by the German government. This huge sell-off, which is more than the German government currently holds, has been significantly to blame for BTC drop to $57,039, as reported by CoinMarketCap.