Bitcoin’s price has gone down today, as have the prices of other risky assets around the world as worries about the economy grow. As worries about a recession caused the market as a whole to drop, the top coin fell by 3.30 percent to around $55,600, its lowest level in a month.

The price of Bitcoin has gone down at the same time that the S&P 500 futures have gone down 0.4%. This comes after the index had its worst day since the market crash on August 5. Investors are getting more worried about the chance of a U.S. recession.

Important economic data is due out soon that will give us more information about the economy and how the Federal Reserve might react.

A jobs report coming today is expected to show that the job market has slowed down. This will add to worries that were already there after recent data showed that manufacturing activity fell for the fifth month in a row. As attention shifts from inflation to economic growth, weak macroeconomic signs hurt stocks and risky assets like cryptocurrencies.

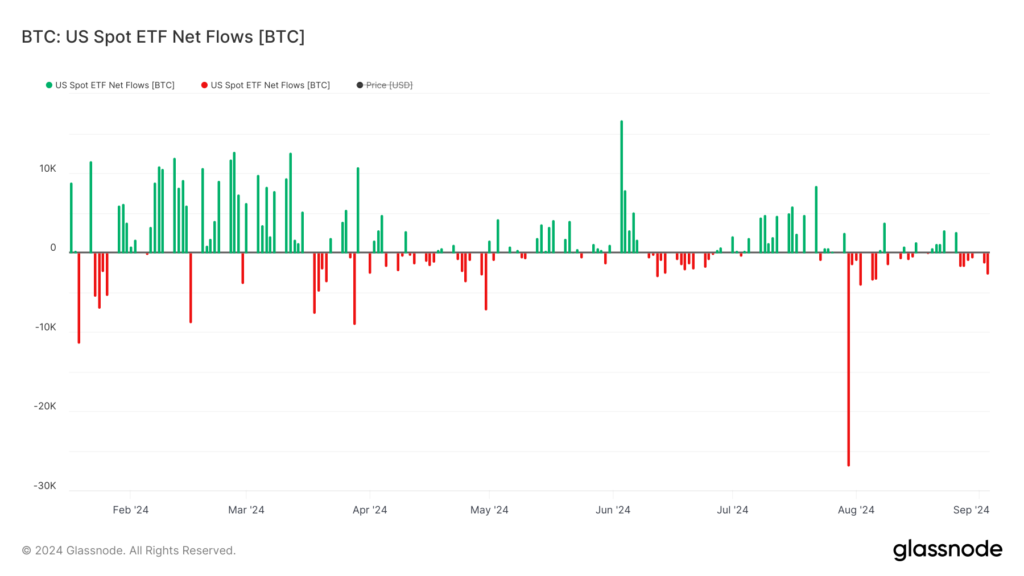

Bitcoin ETFs See Largest Outflows Since June 2023

Daily withdrawals of $287.80 million have been observed for ETFs connected to Bitcoin. Since June, this is the largest outflow stretch and aggravates Bitcoin’s issues even more.

This trend indicates that those who invest are growing less ready to accept chances. Given the state of the economy, they are substituting safer assets for riskier ones.

The futures market shows the decline in Bitcoin’s price as well since open interest (OI) has been declining there. As of September 4, the value of all available Bitcoin futures contracts had slumped to roughly $30 billion.

In July it had peaked at $37.50 billion. This decline indicates that traders are lowering their futures holdings since they are losing trust in the short-term pricing fluctuations of Bitcoin.

Also, evidence from during the day shows that the funding rates for Bitcoin futures have dropped significantly. Funding rates dropped from 0.0074% per eight hours to 0.0007% between September 3 and September 4.

This shows that there was less demand for leveraged long positions. This means that fewer traders are betting on Bitcoin’s price going up in the short term, which is another sign that the market is being cautious.

In a technical sense, Bitcoin’s losses today are part of a phase where the pattern breaks down within an ascending wedge. A rising wedge pattern is a bearish chart pattern made up of two trendlines that are going up and meeting. If the price falls to the level of the lower trendline, which is equal to the biggest difference between the two trendlines, the pattern is likely over.

If this trend continues, Bitcoin could drop another 4.5% from where it is now, to around $54,000 in September.

But if the price goes up from where it is now, which is around $56,300 at the 0.618 Fibonacci retracement support level, the negative setting might not work. BTC could go up to about $59,000, which is the 0.382 Fibonacci level in this case. There is a chance of a 5% gain.