Matt Hougan, Chief Investment Officer at Bitwise, talked about the upcoming Bitcoin halving event and said that investors in the bitcoin market should take advantage of it. Hougan called this year’s Bitcoin halving a “buy the news” event in an interview with CNBC on April 19, pointing out how important it is in the world’s most significant cryptocurrency asset class.

If you look historically at halvings, the price action within a week or two after the Bitcoin halving is relatively muted. But if you look out at a year, BTC prices have rallied substantially after each of the past three halvings and I think it will do so again. Matt Hougan, Bitwise CIO

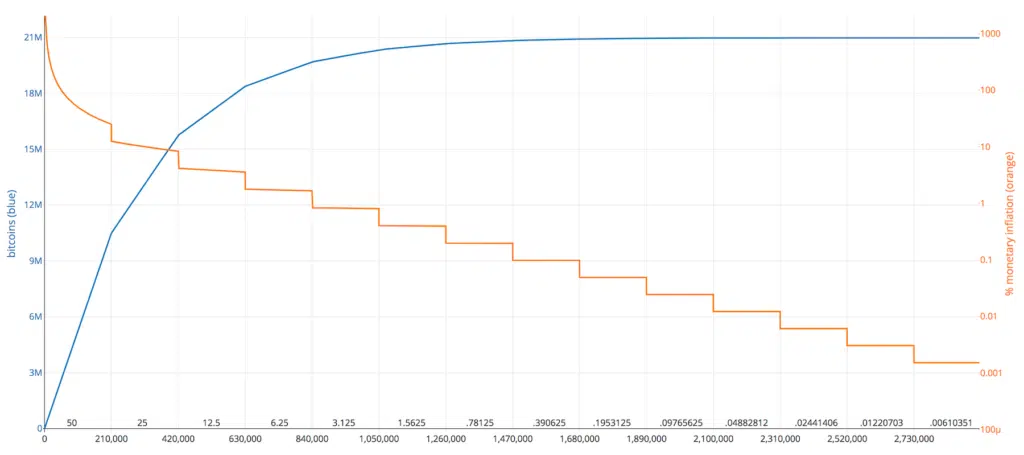

The BTC halving is a change that was programmed into the BTC protocol by the mysterious author Satoshi Nakamoto. Its goal is to control BTC rate of inflation and keep it scarce. Because of this system, mining benefits are cut by half automatically every four years, or after every 210,000 blocks are mined.

Bitcoin’s Halving Fuels Price Surge

As a result of the split, the amount of new BTC entering circulation also goes down by the same amount. Many experts think that the prices will go up soon because there are fewer BTC available and more people want to buy them through spot BTC ETFs. Hougan agrees with this point of view because his business deals with BTC ETFs.

The amount of new supply of Bitcoin coming into the market is being cut in half. We’re removing $11 billion of annual supply. I think big picture, that has to be good for price and that’s what I would expect over the next year. Matt Hougan, Bitwise CIO

CEO of Coinpass Jeff Hancock said that BTC has changed from a speculative asset to a real investment choice that has a lot of institutional interest. He thinks that this change will have a different effect on the current cycle, especially since the global economy is currently experiencing high prices and interest rates.

A historic market opportunity could present itself this Bitcoin cycle, after the 4th halving event. Bitcoin ETFs have already successfully launched in the US, we now have pending ETFs in Hong Kong, ETNs on the London Stock Exchange, and Bitcoin prices are already pushing all-time highs before the halving, something that has never happened before. Bitcoin’s market future has an unlimited potential in my opinion. Jeff Hancock, Coinpass CEO

Hancock thinks that people will still want BTC long after 2024, and that standard finance (tradfi) will continue to work with the crypto ecosystem. Notably, in less than six months, spot BTC ETFs have already grown their assets to over $60 billion.

Hancock also says that the success seen with spot Bitcoin ETFs might be able to be applied to an Ethereum version, even though the U.S. Securities and Exchange Commission (SEC) seems to be against it.

Institutional demand for Bitcoin is here to stay. Ethereum ETFs could follow in 2024, meaning institutional investors will now have access to staking rewards and decentralized finance through an institutional instrument. Jeff Hancock, Coinpass CEO