A new report from the blockchain analytics company Glassnode says that more and more Bitcoin holders are returning to a strategy of holding on to their coins and collecting more of them.

There have been a lot of distribution pressures on the cryptocurrency market for a few months now. However, buyers are starting to favor long-term holding over short-term selling, which could start a major shift.

In the cryptocurrency community, “HODLing,” a term that comes from a misspelled word that means “hold,” has come to mean a long-term investment plan.

As the market returns from its biggest downtrend of the current cycle, this trend starts to show. Many investors are cautiously optimistic as they try to make sense of the uncertain market conditions.

Even though Bitcoin’s price dropped recently, it seems to be recovering, which could mean that the market will be stable. Analysts at Glassnode said that investors are still unsure what to do, but they are seeing a clear trend of more people holding on to their investments.

The report said, “However, looking at how investors are reacting on-chain to these unstable market conditions, a trend of a preference for HODLing is beginning to emerge.”

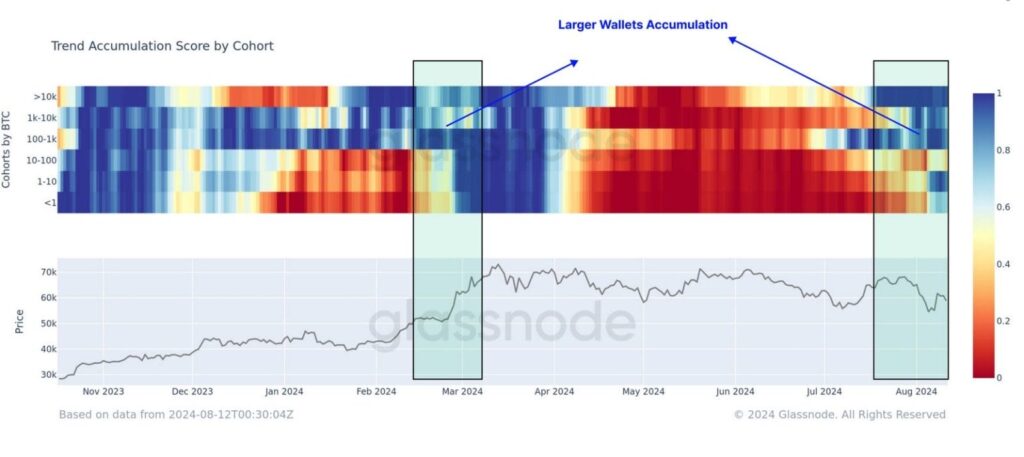

In March of this year, Bitcoin hit an all-time high of $73,737. After that, the supply was spread out over a long period of time among wallets of different sizes. The last few weeks, however, have seen early signs of a change in this trend.

This is especially true among the biggest wallets, which are usually owned by institutional investors and exchange-traded funds (ETFs). Glassnode’s report said, “These big wallets seem to be returning to a regime of accumulation.”

Bitcoin Holders Display Patience Amid Market Volatility

The study said that the recent “choppy sideways price action” has made it less urgent for LTHs to give away their money. This has made their general wealth level level off and then rise. Even when compared to other all-time high breakouts, this wealth is still very high, which shows how strong these long-term buyers are.

Also, LTHs are less likely to sell their coins for less over time, even if the market goes up or down. Those who hold are getting stronger and more patient. Analysts at Glassnode said this shows that long-time Bitcoin users are more driven and still hold on to their coins even when the market is down.

It’s also less likely for LTHs to sell their coins for less over time, no matter how much the market changes. Held-up people are getting stronger and more patient. Glassnode analysts said this shows that long-time Bitcoin users are more determined and will keep their coins even when the market is down. The LTH Sell-Side Risk measure was also looked at.

BTC prices were back above $60,000 as of Wednesday morning (UTC). They’ve increased by 2.6% in the last 24 hours to $60,795. People are more likely to buy and keep Bitcoin now that its price has increased because they think it will be useful in the long run.

The market is still recovering from the price drop. People who have Bitcoin have told Glassnode that they will wait to spend their money. They think prices will go up, which will make them more money in the long run.