People working with CryptoQuant are worried that Bitcoin miners might give up if the cryptocurrency doesn’t recover significantly. As summer approaches, the analytics company warns that miners will face major challenges, especially if prices don’t rise significantly during the warmer months.

Even though Bitcoin recently fell below $58,000, which caused some weaker investors to sell their shares, Bitcoin miners have not yet given up in large numbers. Julio Moreno, head of research at CryptoQuant, told that the network’s hashrate is still a little higher than it was before the split. This means miners can still make funds with equipment that works well.

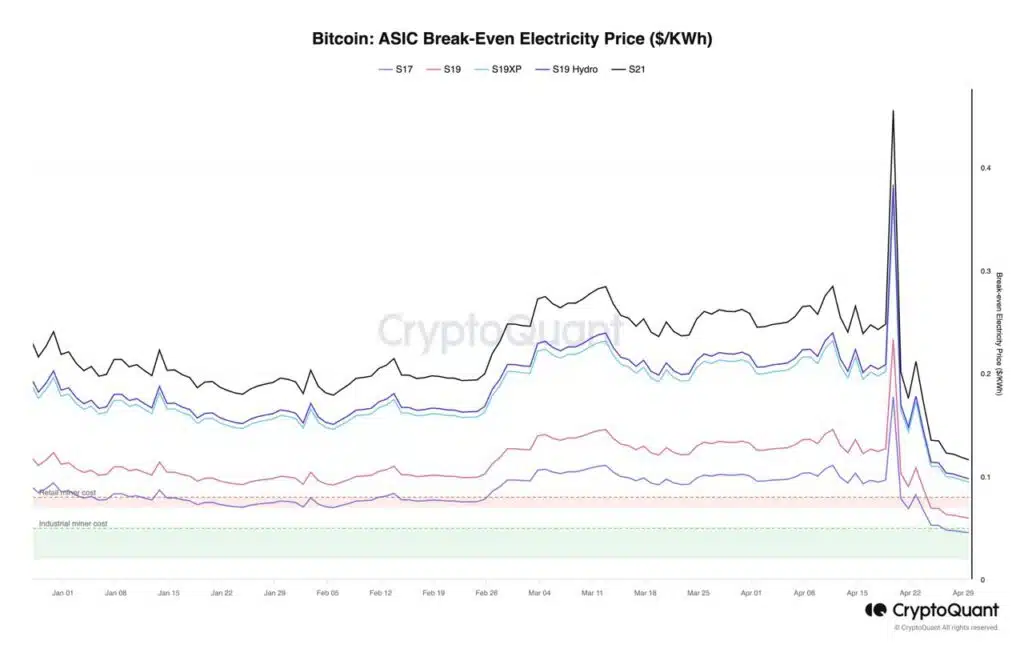

Bitcoin’s profitability varies, and ASICs struggle.

Moreno talked about the point at which it’s no longer successful, especially for ASIC types S19 and S21, since they still use more electricity than big industrial miners.

He did warn, though, that small miners who use older ASICs like the S17 and S19 might lose money because the power cost is increasing. Moreno said that the possibility of a capitulation event would depend on how network hashrate and prices change over the next few weeks.

Concerns were raised about how prices might change during the summer trade slowdown. Moreno said miners usually respond to price changes instead of changing them. Even so, he agreed there might be more pressure to sell Bitcoin in the coming months.

Bitcoin miners are holding on to their crypto holdings at current prices, even though revenue has dropped to levels not seen since early 2023 because of the recent halving, which lowered fixed block rewards from 6.25 BTC to 3.125 BTC. CryptoQuant CEO Ki Young Ju told miners they have two choices: give up or wait for Bitcoin’s price to rise, which is now trading below $58,000.