‘Euphoria’ phases of the market have been linked to a certain amount of price volatility in the past.

In its most recent weekly report, Glassnode points out that Bitcoin’s recent stabilization is close to the line that has historically separated the “equilibrium” and “euphoria” phases of a bull market. The Realized Price for long-term holders (LTH) is multiplied by this key number to get it. The Realized Price is based on what Bitcoin buyers think the price was when they bought it.

When Bitcoin’s spot price is higher than this number, buyers usually make major. If, on the other hand, the spot price is less than the Realized Price, it means that most of the blockchain’s assets have lost value. In this case, the Realized Price for LTHs—investors who have hung on to their Bitcoin for more than 155 days without selling—stands out.

Bitcoin Realized Price Trend

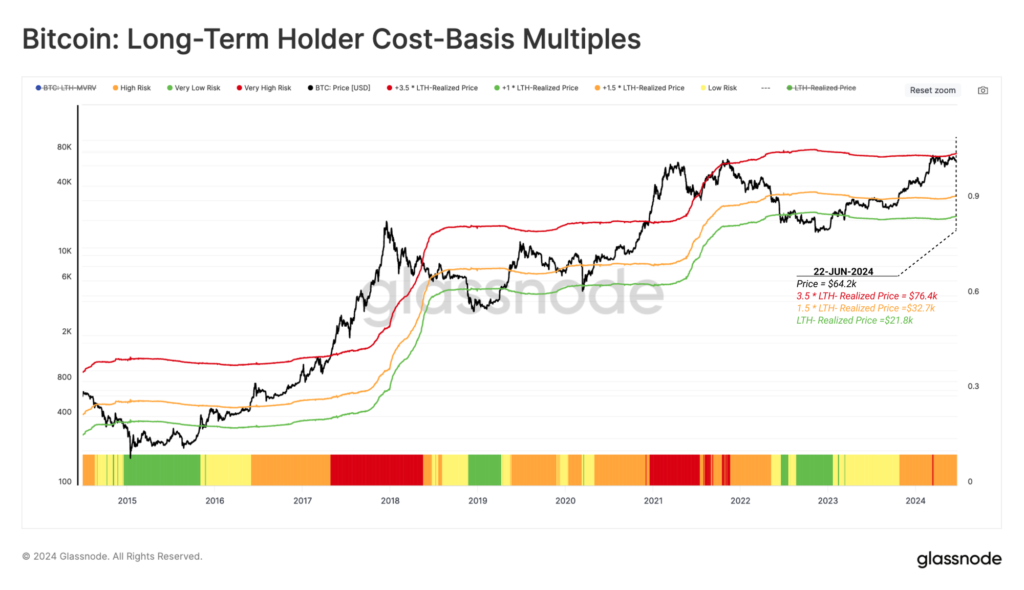

In the next chart, you can see how the LTH Realized Price and its multiples have changed over the last ten years. At this moment, the LTH Realized Price is about $21,800, which is a lot less than BTC spot price. This means that LTHs are likely making a lot of major right now.

The longer an owner holds on to BTC , the less likely it is that they will sell. LTHs are usually the most stable buyers in the market because they are less affected by changes in the market. However, even these resolute buyers may think about selling when their gains get significant.

In the past, the “euphoria” phase began when Bitcoin’s price went above the 3.5x ratio of the LTH Realized Price, which is currently $76,400. The picture shows that Bitcoin’s price went through the roof after breaking through this level during the last two bull runs.

No one knows how long it will take for BTC to break through this barrier, leaving the current “equilibrium” phase and possibly entering a state of market excitement. BTC has been moving closer to the lower end of its consolidation range lately. It is now selling around $61,000.