The amount of action on the Bitcoin blockchain has dropped significantly, which has caused its price to move slowly. People who trade have slowed down a lot in the two months since Bitcoin hit a new all-time high.

A data analytics company called Santiment has found that on-chain action on the Bitcoin network has slowed down a lot in the past few months. This gives us a more complete picture of the current state of the cryptocurrency.

Santiment said in a May 11 update that on-chain activity on the Bitcoin network has dropped to its lowest level since 2019. This opinion is based on the fact that many measures, such as the number of transactions, the number of daily active addresses, and the number of “whale” transactions, are clearly going down.

Bitcoin’s On-Chain Activity Insights

According to Santiment’s research, the number of on-chain Bitcoin transactions is getting close to its lowest level in ten years, and the number of daily active addresses is at its lowest level since January 2019. Also, the company’s data shows a significant slowdown in “whale” transactions, which are usually deals worth more than $100,000. These transactions are now at levels last seen in December 2018.

At first, the drop in activity on the blockchain might make people worry, but experts at Santiment think it might not directly mean that BTC prices are about to drop, as we’ve seen in recent weeks. Instead, they say that traders’ “crowd fear and indecision” caused the drop. This shows how closely on-chain action and market sentiment are connected.

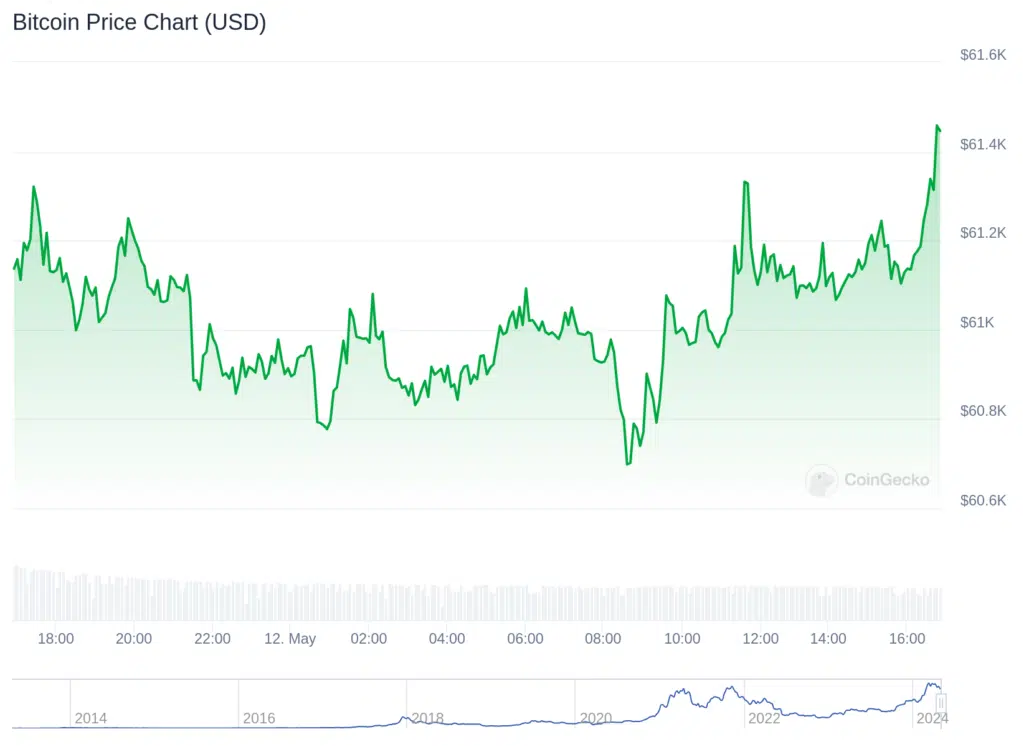

Even with these problems, Bitcoin’s price stayed pretty stable at the time of this report, just above $61,000, with a small 0.1% rise in the last day. Its 24-hour trade volume, on the other hand, was $12.67 billion, which was 37% less than the previous day. Cryptocurrency prices around the world fell 4.2% over the course of seven days, while Bitcoin’s price fell 4.6%. This shows that Bitcoin did not do as well as the entire crypto market.

Investors will have to get through this period of consolidation and slow action on the blockchain. In the coming weeks, market sentiment and larger economic factors will likely have a major impact on Bitcoin’s path.

In other news, a Dune Analytics dashboard shows that the Runes protocol on Bitcoin has collected $135 million in transaction fees on the biggest blockchain of the cryptocurrency. On-chain data also showed that within a week of the halving, tokens released under this standard brought in more than 2,100 BTC. But since then, things have slowed down a lot. According to a Dune Analytics dashboard used by The Block, the least amount of action on the Runes protocol happened on May 10.