New on-chain data shows that Bitcoin long-term users have been selling, which could be adding to the cryptocurrency’s long-term downward trend.

A post by an analyst on CryptoQuant Quicktake says that a lot of old cryptocurrency tokens have been put on centralized platforms.

“Exchange Inflow Coin Days Destroyed (CDD)” is the most important number in this case. One Bitcoin stays idle on the blockchain for one day, which is called a “coin day.” This coin’s collected coin days are “destroyed” when it moves. They are reset to zero.

The coin days being reset across the network are tracked by the CDD. The Exchange Inflow CDD is especially important as it shows how many coin days are lost when transactions go into exchange wallets.

Bitcoin Exchange Inflow Surges

The Bitcoin Exchange Inflow CDD has seen substantial jumps this month, which means that a lot of coins that have been sitting idle have recently been put into exchanges.

Long-term holders (LTHs) usually cause spikes in the CDD because they hold coins for a long time and collect a lot of coin days. So, recent spikes show that these coin holders have moved their coins to exchanges, maybe to sell them.

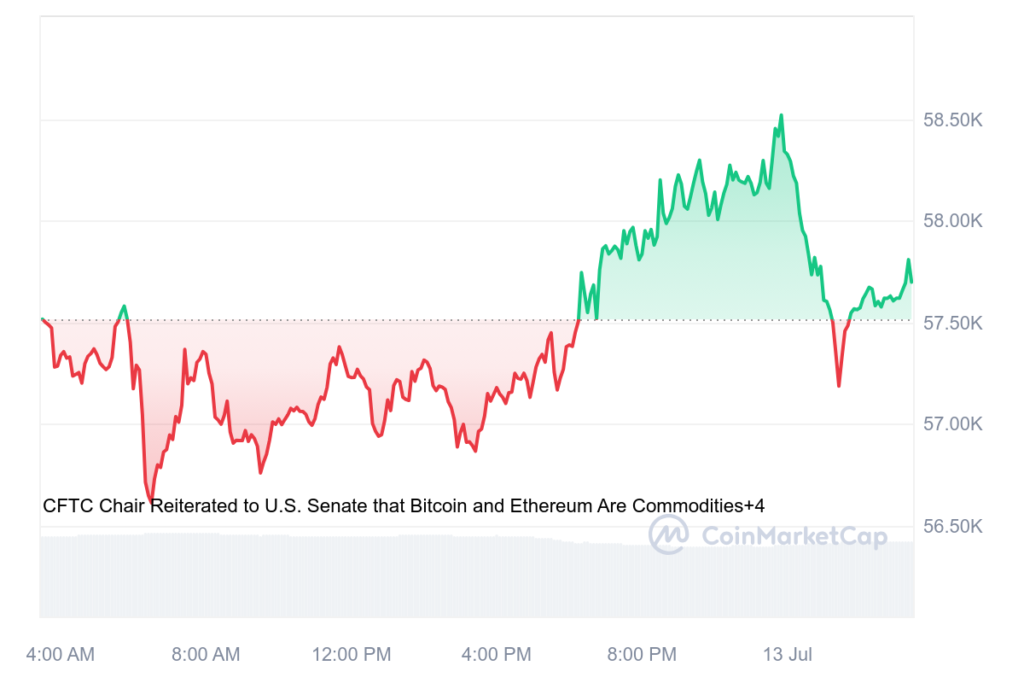

People who own coins usually take them to swaps for services, such as selling. The chart shows that these price increases happened at the same time that Bitcoin hit its lowest point earlier this month. This suggests that LTHs added to the drop in price.

The most recent and sharpest spike happened when BTC tried to return from its lows by going on a rally. Bitcoin has had a hard time getting back on track so far, which suggests that selling from LTHs may be slowing it down.

How the Exchange Inflow CDD acts in the future will be very important in figuring out if more spikes will stop Bitcoin from getting better. Bitcoin is worth about $57,900 at the moment, which is more than 4% more than it was a week ago.