Bitcoin prices went back up to $66,000, which caused short-term holders to sell their holdings for little to no profit, according to sources.

CryptoQuant experts say that even though major financiers are very interested in Bitcoin, the momentum that is needed to keep this rise going has not yet materialized. Bitcoin’s value went up again late Wednesday night after news that inflation rates in the US were lower than expected. However, short-term players who wanted to cash out did not make a lot of money.

Bitcoin Holders Sell At Loss.

A recent study by CryptoQuant showed that people who only hold Bitcoin for a short time are selling their assets “at essentially zero profit.” Even with this trend, experts stressed how important it was for growth to speed up in order to support the current rally.

[…] traders are now experiencing unrealized losses on their positions, a situation that in the past has coincided with a local bottom in prices. CryptoQuant

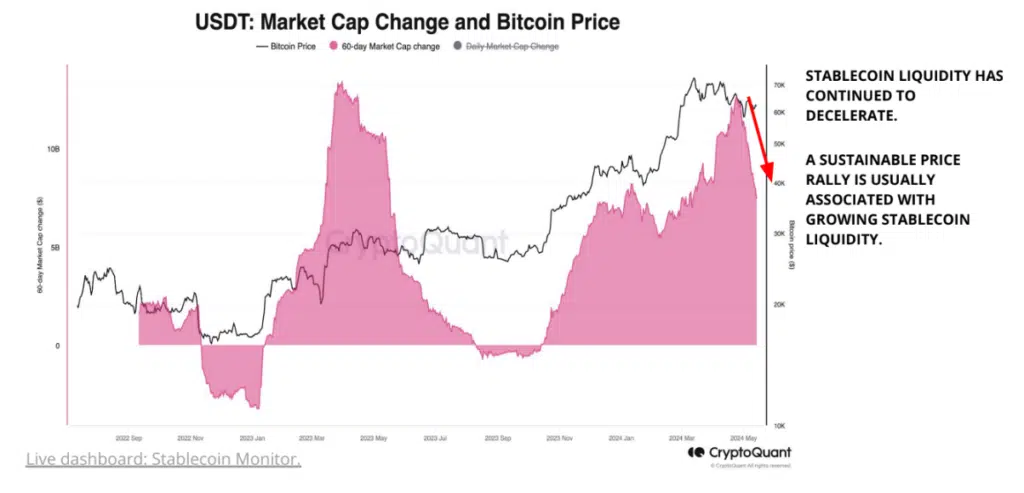

The report also pointed out that the balance of Bitcoin across over-the-counter trade desks has been stable since the end of April. This means that less Bitcoin is coming in through these channels. Analysts did warn people to be careful, though, pointing out that the growth of stablecoin volume has slowed down, which is usually a sign of long-term price increases.

Analysts also said that BTC price was relatively cheap when it came to miner profits.

Bitcoin miners are currently extremely underpaid and their profitability has fallen to the lowest since March 2020, a few days after the COVID market crash. CryptoQuant

Meanwhile, experts at the blockchain company Kaiko said that the recent split event could force miners to sell their holdings if prices don’t quickly rise again. This is happening because daily average network fees are going down. They went up after being cut in half, but they are now going down. Kaiko said that the original excitement about the Runes protocol has faded, which is why network fees have slowed down.