After a 4.1% decline from Oct. 21 through Oct. 22, Bitcoin is in a bear head and shoulders pattern, having fallen from resistance at $69,500 and losing the gains seen the previous week. Now traders are wondering if Bitcoin can break $67,000.

The drop came as the S&P 500 fell from its Oct. 18 peak, giving investors cause for caution. At all, factors in favor of alternative assets are still strong. For instance, gold made a new high on Oct. 22. Billionaire hedge fund manager Paul Tudor Jones told CNBC that U.S. inflationary policies will continue regardless of the political climate.

Bitcoin As Inflation Hedge Recommended

While Jones did recommend gold as a hedge against inflation, he also recommended BTC as ‘a hedge against yet another asset class, which is underexposed to, commodities.’ He also warned U.S. dollar devaluation resulting from rising deficits and longer term Treasury yields as well.

Treasury yields are rising because people doubt the Federal Reserve can engineer the economy without causing a downturn. Despite the uncertainty, Bitcoin’s fundamental strength is still there and if anything, ever growing, as more and more people have begun to seek gold and investors doubt other traditional markets.

CEO of Blockchain Association Kristin Smith predicts the U.S. Congress in 2021 will be more crypto friendly and many new candidates are supporting digital assets. This could help BTC regulatory environment grow support among lawmakers.

In addition, BTC exchange traded funds (ETFs) also show strong demand. Assets under management jumped to $51.7 billion and net inflows into Bitcoin ETFs hit $2.68 billion since Oct. 11, Farside Investors and CoinGlass said.

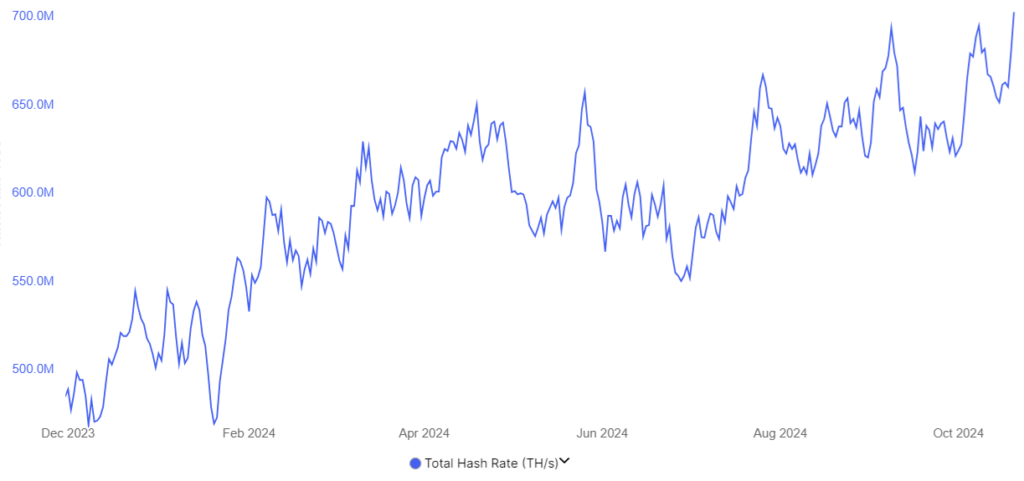

Combined, Bitcoin’s rising hashrate, an indicator of network processing power, suggests optimism among miners who are investing in mining infrastructure even through that long term profitability horizon. The relief in selling pressure from miners means momentum may be returning to Bitcoin, and a $67,000 support level could reemerge.