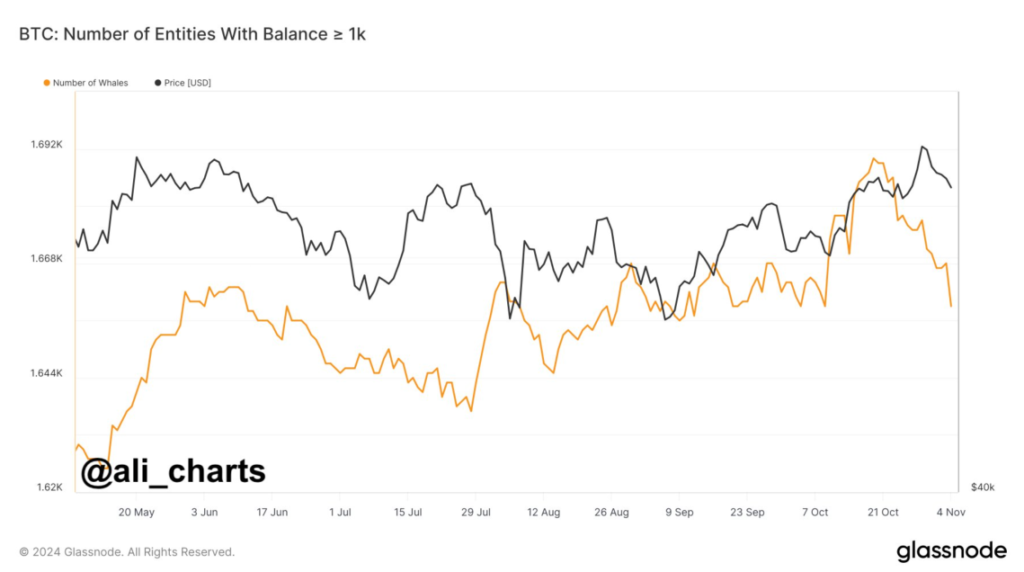

With Bitcoin (BTC) whales wallet addresses with more than 1,000 Bitcoin taking some action to reduce holdings as the 2024 U.S. presidential election draws nearer, it may be wise not to get too euphoric over BTC at current prices.

Crypto analyst Ali Martinez noted of a 2% drop in these large BTC addresses that high stake holders appear to be getting ready for market volatility that may come from election outcomes.

Earlier this month, the BTC whale count reached an apex of 6,668 in mid October, which corresponded with Republican presidential candidate Donald Trump’s strong polling lead.

Bitcoin Selloff Amid Election Uncertainty

Prediction platform Polymarket now puts Trump’s chances of winning at 62.7 percent, with Harris at 37.4 percent. A shift in the wallets of major Bitcoin Holders may be signalling a fear of what future regulatory approaches to digital assets look like.

Trump’s call to make the U.S. the “crypto capital of the world” has contrasted with the perceived hostility toward the crypto industry the Biden administration has faced. Over the past week, 177,000 BTC have been sold by long term BTC holders, fueling the selloff trend.

Since September 2024, retail BTC demand has seen a 13% rise according to data, so it appears retail investors are filling in the gap. This shift calls to mind the feeling of risk on by smaller investors, with increases on the market matching the drops as whales reduce position.

On the BTC 12 hour chart, a TD sequential buy signal is pointing to reversals in the potential trend, according to Martinez. Yet analysts warn even a Trump victory won’t prevent Bitcoin prices from falling if it cannot hold above the $68,000 support; a drop under could see BTC headed for $63,000. At the time of writing BTC is trading at $69,595, a 1.3% increase in the last 24 hours.