Launched in 2011, Bitcoin, the first cryptocurrency, has evolved into a notable financial tool surpassing Warren Buffett’s well-known portfolio and traditional American stock markets.

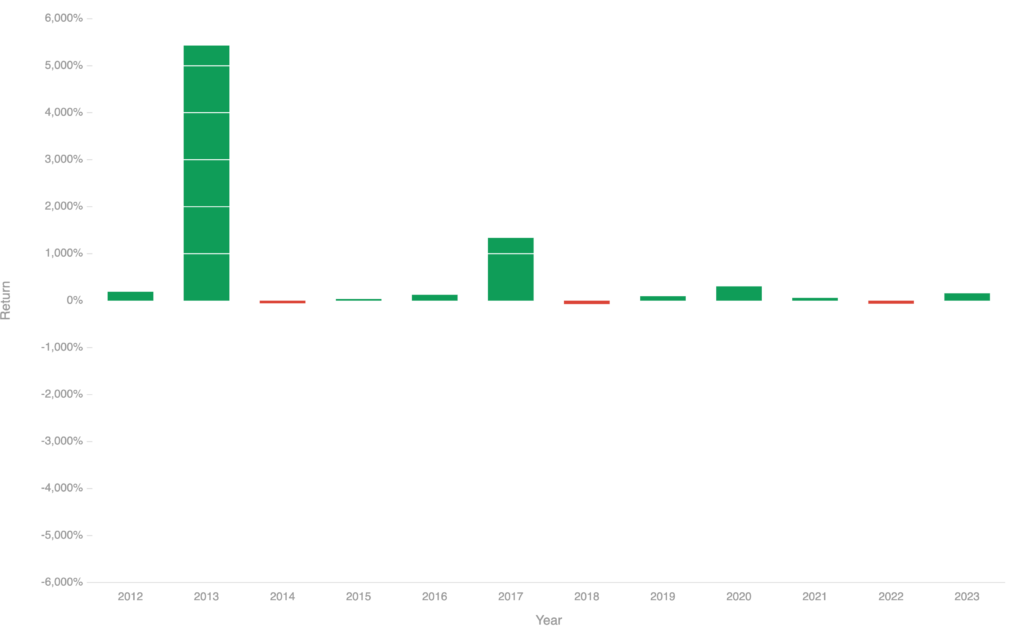

Having started a trade more than ten years ago, BTC has exhibited an incredible average annual return of around 104%. With top holdings in Apple, Bank of America, American Express, Coca-Cola, and Chevron Corp., this number far exceeds the profits Warren Buffett’s portfolio yields.

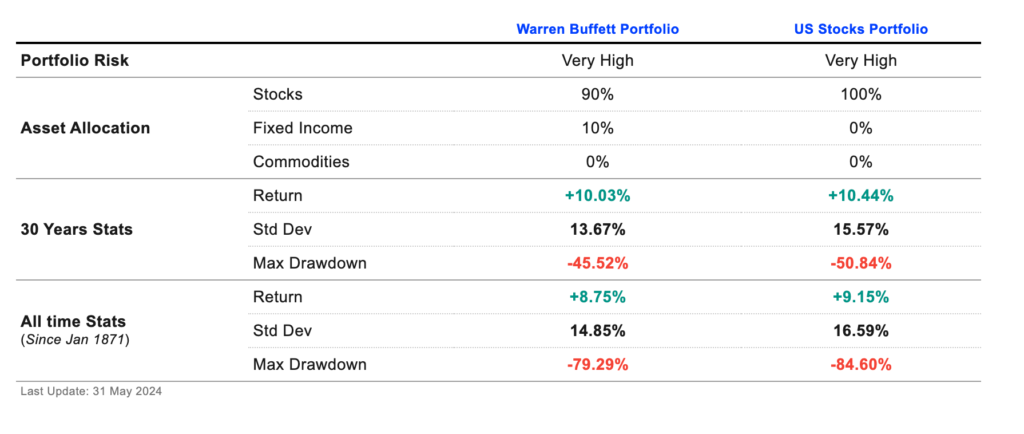

Regarding the risk-reward profile, Bitcoin’s compound annual growth rate (CAGR) deviates from that of Buffett’s portfolio returns. Celebrated for its concentration on logical risk management and long-term value investing, Buffett’s portfolio has had a CAGR of 10.03% over the past 30 years with a standard deviation of 13.67%.

By contrast, from its launch, BTC has shown incredible performance averaging a yearly return of about 104%. This figure frequently outperforms American stock markets and Buffett’s portfolio over the last 13 years.

Bitcoin’s Role as “Digital Gold” and Volatility Compared to Buffett’s Portfolio

Bitcoin’s incredible success has made it well-known as “digital gold,” a potential counter against inflation and depreciation of funds. To raise Bitcoin’s appeal among institutional investors, several American companies—including MicroStrategy and Tesla—have placed it into their reserves.

Still, compared to Buffett’s more consistent portfolio, BTC is somewhat unpredictable. Though its price displays less volatility than several S&P 500 companies in recent years, it is nonetheless susceptible to substantial fluctuations.

Though it presents the chance for big gains, Bitcoin comes with more volatility and risk than Buffett’s measured investment strategy. Given exposure to BTC or traditional investment vehicles such as Buffett’s portfolio, individuals must carefully balance their investing objectives with risk tolerance.

The way BTC performs emphasises its transformational power as an asset class. As the landscape of cryptocurrencies shifts, Bitcoin challenges accepted wisdom about investments and offers new avenues for portfolio diversification and wealth building.