Experienced investor and financial guru Bill Miller IV confirmed in a recent blog post “Why I’m Still Betting on Bitcoin,” his positive assessment of Bitcoin. Son of well-known investor Bill Miller III, Miller Value Partners Chairman and CIO thinks Bitcoin is in the early phases of a major change in global capital and governance viewpoints.

In 2015, Miller originally presented his thesis on Bitcoin in his paper “A Value Investor’s Case for…Bitcoin?!”,” stressing Bitcoin’s possible role as a revolutionary payment system or substitute for conventional fiat currencies.

He notes BTC explosive rise today, but he thinks its promise is yet mostly unrealized. He sees BTC market capitalization at about $1.5 trillion as insignificant compared to the almost quadrillion-dollar worldwide fiat capital system.

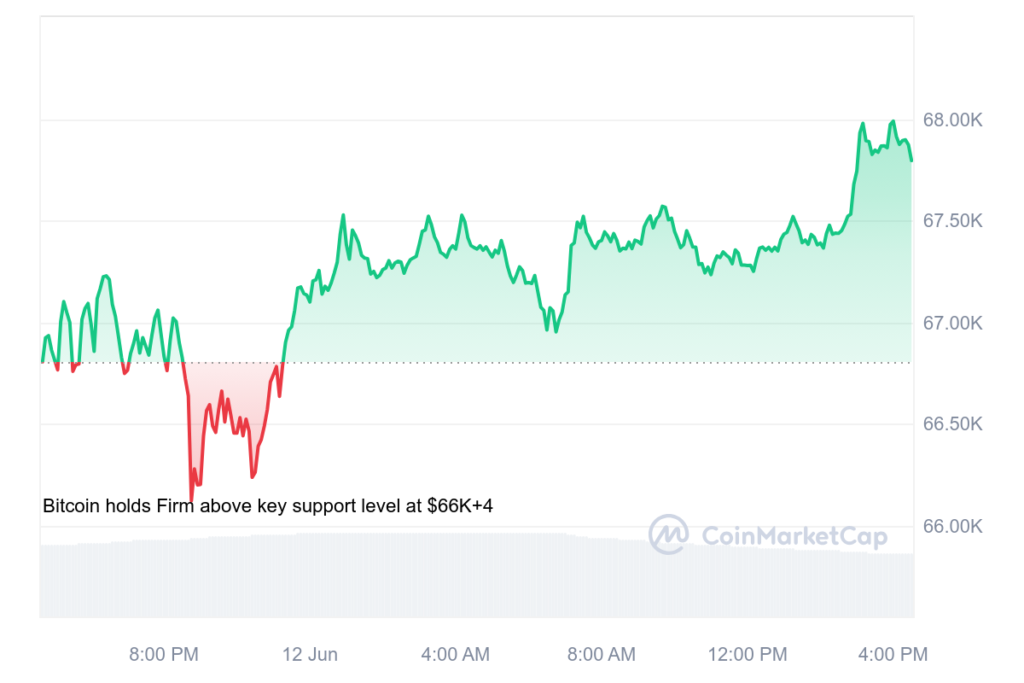

Bitcoin’s Undervaluation Despite Highs

“Despite BTC recently hitting new highs against every fiat currency, I believe Bitcoin today is still significantly undervalued and that the world is likely in the early stages of a secular shift around how humans think about capital and its governance,” Miller says. He attacks present monetary systems for their vulnerability to human mistake and manipulation, which causes inflation and mismanagement to devalue currencies.

Miller backs up his claim with references to Lyn Alden’s “Broken Money,” which details historical events of better financial technologies surpassing their antiquated forebears. According to Alden’s study, when given better financial options, consumers often choose them. Miller argues, supporting BTC distributed, open, unchangeable ledger as a strong substitute for fiat systems, “History shows that the best monetary technology inevitably wins, as people trade inferior depreciating capital technologies for superior ones.”

Examining BTC technical and philosophical roots, he calls it a “true technological breakthrough.” BTC runs worldwide without centralized authority unlike conventional monetary systems, allowing transactions free from censorship and seizure. Miller argues that this quality drastically changes the way property rights are passed on and controlled over borders and generations.

Miller also notes significant returns from businesses like NVIDIA, Google, and Meta as proof of successful paradigm changes, addressing public difficulty in understanding and value for new technologies. “Humans are notoriously poor at contextualizing the relevance and potential of new technologies,” he says, drawing comparisons between BTC promise to these innovative enterprises.

Miller ends his case by noting the hazards and volatility of Bitcoin, which he regards as an asset class currently under development subject to shifting opinions and legal environments. He does caution, though, that underestimating Bitcoin’s long-term potential might be as negative as ignoring early indicators of any significant technical change.

“It’s still early,” Miller says, expressing hope that as the world investigates digital assets and faces the constraints of fiat currencies, BTC actual value will be realised. This viewpoint not only fits his investing approach but also projects a radical future for world banking.

Press time found Bitcoin trading at $67,406.