The titan of cryptocurrencies, Bitcoin (BTC), rocked the market yesterday momentarily falling below the $60,000 level for the first time since early May. Reportedly sparked by strong sell-offs connected to the German Government and impending Mt. Gox BTC dividends, the sudden decline shook investors all around.

However BTC’s fortitude was evident as it quickly recovered to reach a high of $62,814, driven by growing social media calls for a “bottom.” Although this increase suggested a possible comeback, optimism were dampened when BTC eventually steadied around $61,107 at press time.

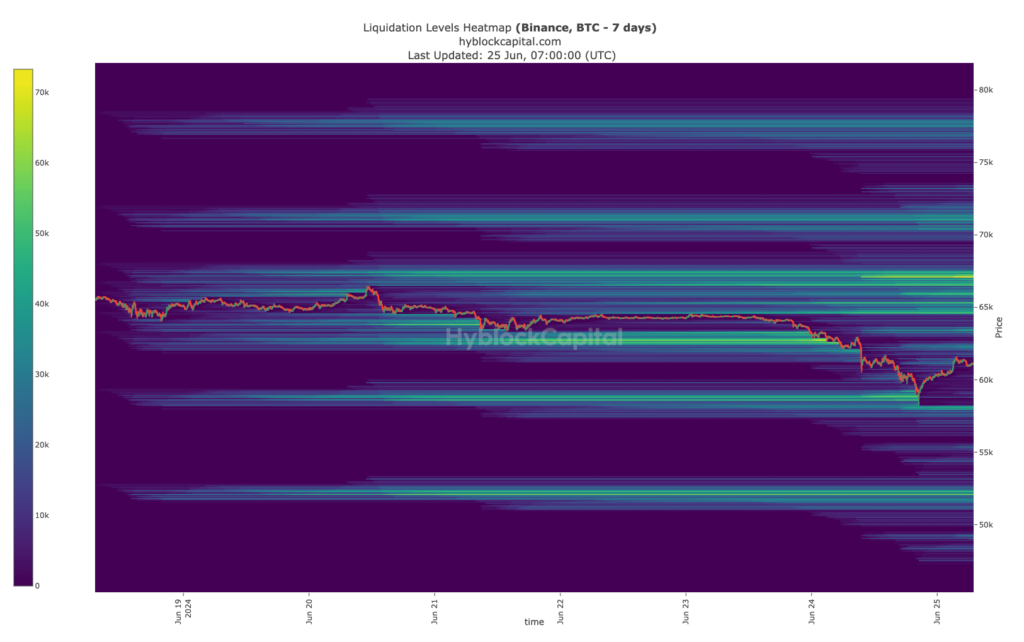

Bitcoin Liquidity Dynamics at $64,600

Analysis exposed fascinating new perspectives on the mechanics of cryptocurrency’s market. The Liquidation Heatmap for the cryptocurrency showed possible price swings, and at $64,600 there was noticeable liquidity. This underlined a vital battlefield where increased purchasing pressure can drive BTC higher and cause short position liquidations.

On the other hand, adverse effects loomed with another liquidity cluster found about $58,150. This implied that once more, rising selling pressure could pull Bitcoin below the psychologically relevant $60,000 mark.

The market frenzy did not spare traders; over the previous 24 hours alone, BTC contracts at a shockingly $152.71 million were sold off. With $121.65 million lost, long positions suffered most and highlighted the great volatility of the market and the dangers of leverage trading.

Given BTC’s short-term path is still unknown, market players should exercise care among continuous volatility. It remains to be seen whether Bitcoin will recover its recent highs or give in to more swings, therefore leaving traders and investors both on edge in the ever changing crypto scene.