Though recent market volatility, analysts’ eye is on Bitcoin’s price path as it shows a possible jump to $91,539. After a little surge to $69,000 following the most recent U.S. Consumer Price Index (CPI) report showing a slowing down in inflation, Bitcoin has stayed stable around $67,506, marking a small increase over the past day among more general market corrections.

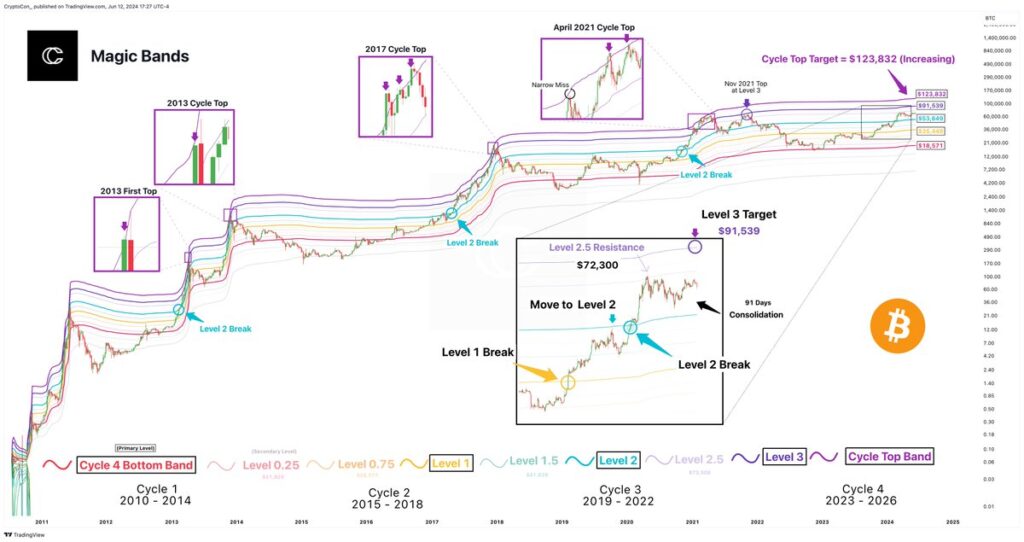

This resiliency runs counter to a 4.7% weekly drop.Using the “Magic Bands” approach on social platform X (previously Twitter), eminent technical analyst CryptoCon is adamant in forecasting Bitcoin’s rise to $91,539.

Bitcoin Market Indicators

With little change expected in 2024, this projection is consistent even with the Federal Reserve’s decision to keep interest rates the same. Based on previous price trends, the model indicates BTC is presently in a ‘level 2.5’ phase ready for a breakout.

Such an action would indicate a significant rise from present levels and might perhaps result in a “Cycle Top Target” of $123,832 as the model projects.Examining market indicators of BTC reveals information from variations in Open Interest and active addresses.

Although general Open Interest dropped 3.11%, a noteworthy 53.11% rise in value points to a tightening market likely to be volatile. Active Bitcoin addresses have also climbed from 3.14 million to 3.36 million, suggesting increasing user involvement that would help to support higher prices.

Moreover, market mood among Bitcoin whales, shown on June 11th, saw notable accumulation of 20,600 BTC (about $1.38 billion) during a price decline, therefore marking one of the biggest single-day purchases by major investors since February. This points to trust in present pricing policies and possible future increases.