Bitcoin’s journey towards new highs met with a temporary pause as profit-taking activities intensified, marking a natural phase in the cryptocurrency’s volatile trajectory, according to insights from Glassnode, a prominent analytics firm.

Reaching $71,375 on March 26, Bitcoin’s surge towards its all-time high was momentarily halted by a wave of profit-taking maneuvers, as highlighted by Glassnode’s on-chain analysis.

The firm noted a significant uptick in profit-taking events, with approximately 2.0 million Bitcoin transitioning from ‘in-profit’ to ‘in-loss’ as the price retraced from its peak to a recent low of $61,200.However, amidst the market’s recovery, around 1.0 million of these coins reclaimed their ‘in-profit’ status, showcasing the resilience of Bitcoin’s investor base even in the face of short-term volatility.

Bitcoin’s Supply Cluster Indicates Profit-Taking Surge

Glassnode’s analysis also identified a noteworthy ‘supply cluster,’ indicating a substantial portion of BTC changing hands at elevated price levels, primarily driven by previous owners capitalizing on profits. The Spent Output Profit Ratio (SOPR) metric variations echoed this sentiment, approaching levels reminiscent of the 2021 bull market’s peak, further solidifying the profit-taking narrative.

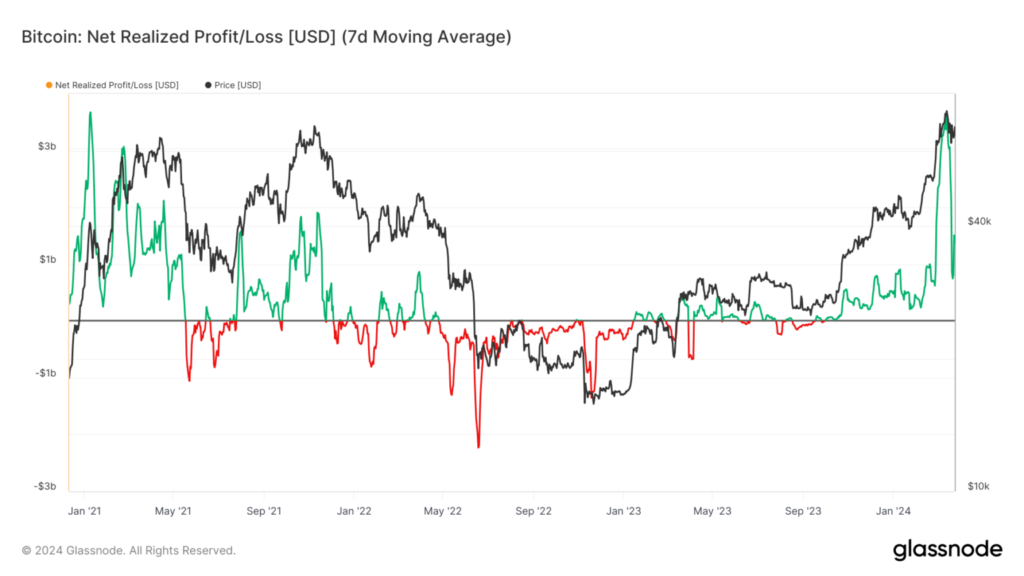

During Bitcoin’s rally to $73.2k, over $2.6 billion in realized profit was secured through on-chain transactions, with Long-Term Holders accounting for 40% of the profit-taking activities. Notably, some investors divesting from the Grayscale Bitcoin Trust (GBTC) contributed to this trend, with significant outflows observed since its conversion to a spot ETF.

Short-term holders also played a role, locking in $1.56 billion in profits, leveraging liquidity and bullish momentum reminiscent of previous market cycles.Commenting on the phenomenon, Clive Thompson, a former Swiss banking director and BTC advocate, remarked, “Each time the BTC price nears an all-time high, there’s a tug-of-war between Bulls and Bears.

This polarization leads to temporary market pauses, which are perfectly normal.”Thompson also pointed out the recent shift in ETF inflows, turning positive after a week of outflows, which could potentially drive Bitcoin’s price towards surpassing previous records.

The observations by Glassnode come amidst a broader recovery in the cryptocurrency market, with Spot BTC ETFs witnessing significant inflows, indicating sustained investor interest despite short-term fluctuations.