Binance Coin (BNB) has become one of the most popular cryptocurrency, even though the market is very volatile. Even though drops of over 10% are usual, BNB has caught people’s attention by going against the market’s downward trend and only dropping 0.35 percent.

Investors are now wondering if this could mean that the coin is moving away from the crypto market as a whole.In the last 24 hours, BNB, the native token of the Binance ecosystem, has been one of the best performers.

This is in stark contrast to the losses seen across most other important coins and altcoins. CoinMarketCap data shows that while other cryptocurrencies lost value, BNB held its own, selling just slightly lower than its value the day before.

BNB’s Resilience Sparks Decoupling Speculation

If you look more closely at BNB’s path over the last day, you can learn some interesting things. It briefly went up to $554 at 4:30 AM UTC on April 18th, but then it went back down and was still at $541 at press time. Even with this small setback, Binance Coin’s strength has raised eyebrows and led to rumors that it might become less tied to the overall moves of the crypto market.

The good changes happening in the Binance ecosystem could be one reason why Binance Coin is relatively stable. The news that Binance had gotten a license from Dubai’s crypto officials to offer more services to small investors in the city gave the market a boost. Binance has a lot more reach and impact now that it can connect with more traders in one of the world’s most important economic hubs.

Along with the governmental wins, news that Binance will soon be back on the Indian market has also made investors feel better. This comes after a ban in early January, which could mean that things are getting better between the exchange and the Indian government.

Also, Binance’s successful completion of the BSC Feynman hardfork, which made native staking and governance on the BSC Chain possible, has given BNB’s chances even more hope.

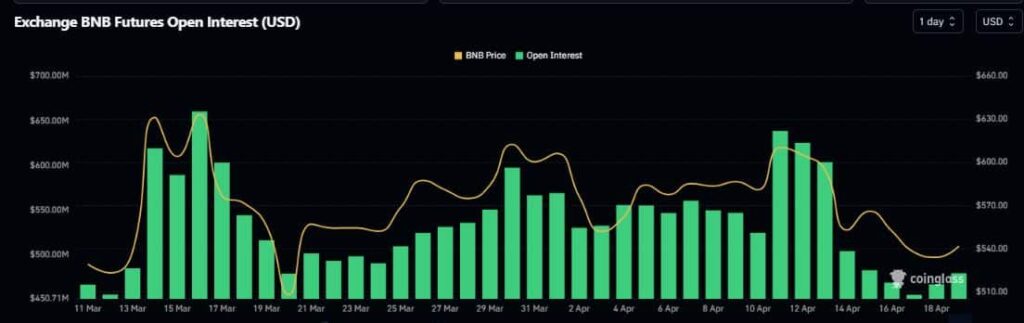

The Open Interest (OI) in Binance Coin futures has grown significantly over the past 24 hours, rising by almost 10% to $525 million. This shows that derivatives traders are also becoming more interested in BNB. Also, the Longs/Shorts Ratio shows that more traders are betting that BNB’s price will go up than are betting that it will go down.