A company called Santiment helps us understand why Cardano (ADA) is a slightly better buy than other well-known coins.

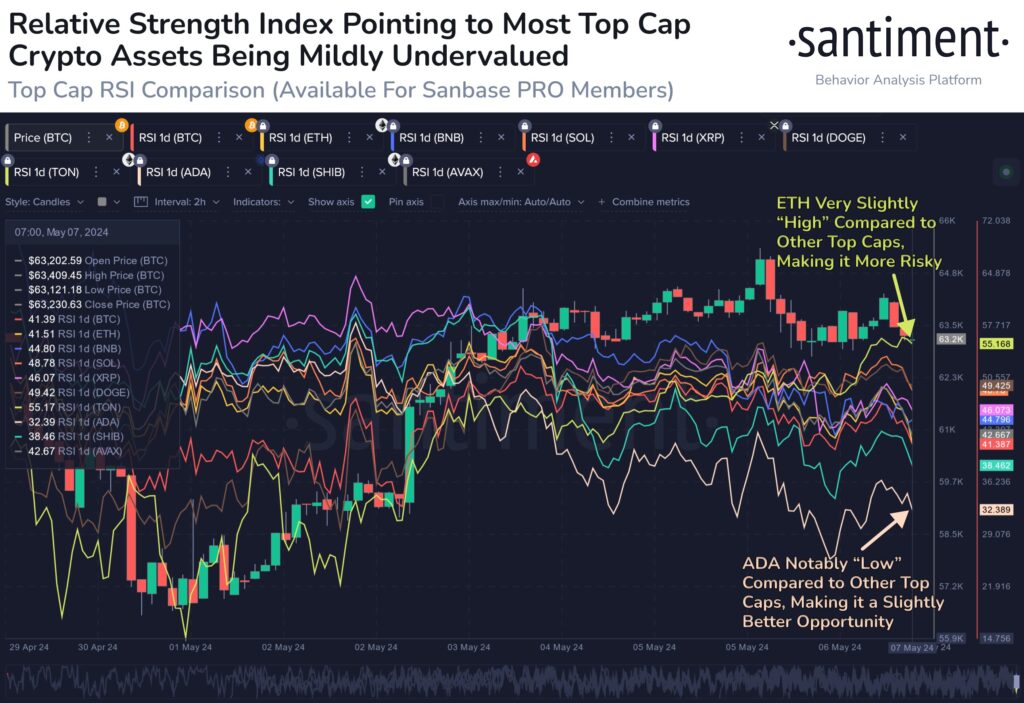

Santiment recently wrote on X about how the best cryptocurrency did on the Relative Strength Index (RSI). The RSI is a technical analysis tool that checks how recently prices have changed and how quickly and how much.

While the RSI is above 70, the price is likely to go up. On the other hand, when it is below 30, the price is likely to go down.

Cardano’s Competitive Edge Santiment’s Insights into RSI Trends

Santiment’s chart shows that Cardano has the lowest RSI number, at around 32.4. There is a chart that shows the 1-day RSI trend for the most valuable coin. These are great chances for ADA to get in, even though the price isn’t quite “underpriced” yet.

RSI levels just below the 50 mark mean that there aren’t many opportunities to buy Shiba Inu (SHIB), Bitcoin (BTC), Ethereum (ETH), and Dogecoin (DOGE), all of which are top assets.

It looks like Toncoin (TON) is a risky choice, though. Its RSI score is 55.1, which is still close to 50, which is the neutral number.

Cardano has a lot of potential, but its price is still not back to where it was before the drop last month. It has been stuck at $0.44 while efforts to go up have failed. A lot of buyers want to know what will happen to Cardano’s price because the RSI shows that it is cheaper than other cryptocurrencies.