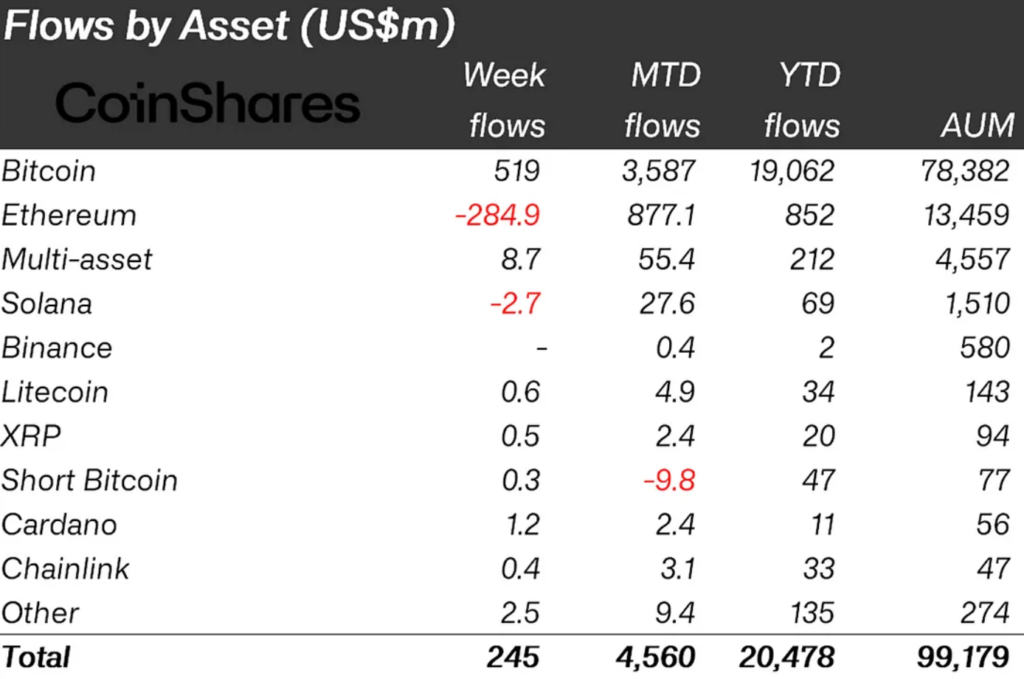

The most recent CoinShares weekly report says that investing in coins is still a great idea. Yesterday, an extra $245 million was put into exchange-traded funds (ETFs) that deal with crypto. The grand total for the year so far is now a strong $20.48 billion, which is a significant jump.

Even though Bitcoin is the most valuable cryptocurrency, it was primarily responsible for this rise. Plenty of significant financial institutions, like BlackRock and Franklin Templeton, have put a lot of money into ETFs that focus on Bitcoin. $519 million has come in here in the last seven days alone. All of this new money that has come into crypto-related financial goods is made up of 97.9% of that amount.

Cardano Gains Significant Momentum

Even though Bitcoin has gotten the most press, people are also interested in other digital investments. One example is Cardano (ADA), which has become a significant winner. Cardano ETPs got $300,000 more in money last week than the week before, for a total of $1.2 million. After this rise, Cardano is now in second place among all crypto ETPs for the week. This means buyers are getting more interested.

Because of the Chang hard fork coming up, more money is going into Cardano. After the hard fork later this year, ADA owners will be able to vote on how to spend the blockchain’s funds, which will make decentralization better on the Cardano blockchain. The Cardano Constitution is also meant to make public the rules and principles that govern how the blockchain works without a central office.

Since these changes are coming soon, the fact that more money is pouring into Cardano ETPs shows that buyers are ready to make money from them. The hard split and the approval of the Cardano Constitution are likely to have significant consequences for the ADA blockchain’s future. This will make buyers even more sure of their investments in Cardano and make them want to buy more.