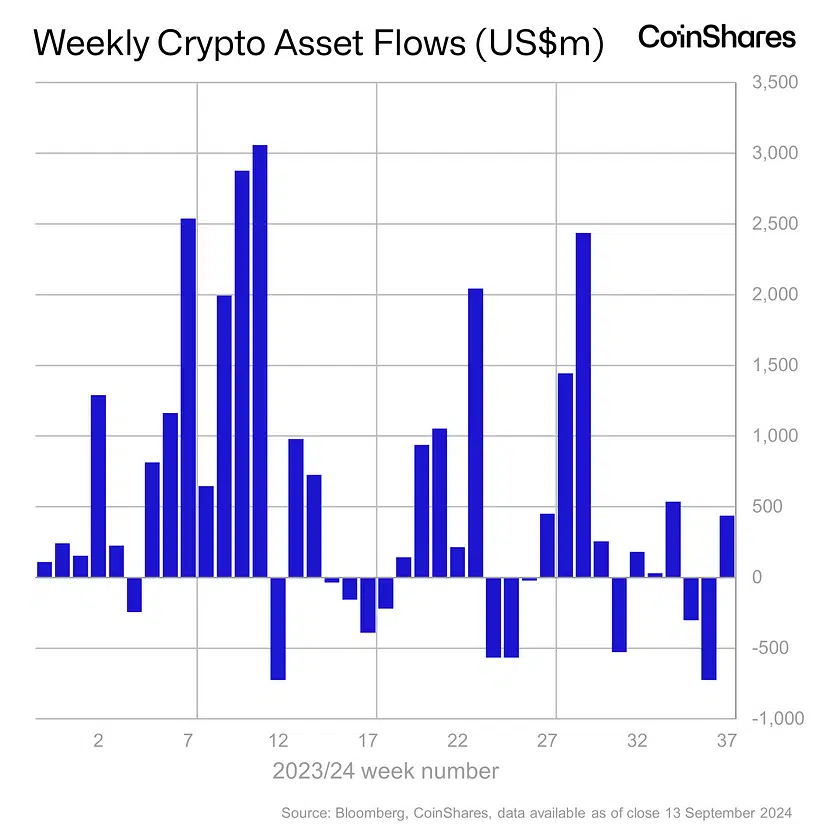

In a notable reversal of previous trends, cryptocurrency investment products received $436 million in inflows, marking the end of many weeks of outflows, according to statistics from CoinShares. This reversal followed a period of $1.2 billion in inflows, suggesting increasing investor optimism spurred by predictions of an anticipated interest rate cut.

The market shift comes as expectations increase around a probable 50 basis point interest rate drop on September 18, after comments from former New York Federal Reserve President Bill Dudley.

James Butterfill, head of research at CoinShares, highlighted that Dudley’s statements have encouraged hopes of a more favorable monetary policy, encouraging investors to return to crypto assets.

Despite the inflows, trading volumes in exchange-traded funds (ETFs) were sluggish at $8 billion for the week, significantly below the year-to-date average of $14.2 billion. Geographically, the U.S. led the rebound with $416 million in inflows, while Switzerland and Germany contributed $27 million and $10.6 million, respectively.

As is typically the case, Bitcoin was the biggest benefactor of the revived interest, pulling in $436 million after suffering $1.18 billion in outflows over the preceding 10 days.

However, short-Bitcoin contracts, which allow investors to profit from drops in Bitcoin’s price, experienced $8.5 million in outflows, showing a decrease in bearish sentiment after three consecutive weeks of inflows into these products.

Crypto Sector Sees Mixed Fortunes Amid Shifting Market Sentiment

Ethereum, on the other hand, continued to suffer issues, registering $19 million in outflows. Butterfill linked this to “concerns over layer-1 profitability following Dencun,” a recent issue hurting Ethereum’s scalability.

In contrast, Solana enjoyed its fourth consecutive week of positive momentum, amassing $3.8 million in inflows.

Blockchain equities also profited from the market move, collecting $105 million in inflows. This surge was mostly driven by the creation of several new ETFs in the U.S., which gave more channels for institutional and individual investors to obtain exposure to blockchain technologies.

The inflows come after a dramatic dip in Bitcoin’s exchange activity just weeks ago, with daily inflows decreasing 68% from 68,470 BTC to 21,742 BTC and outflows plummeting 65% from 65,847 BTC to 22,802 BTC earlier in September.

As the market watches for prospective interest rate adjustments, the crypto sector appears to be getting increased attention from investors, particularly in key regions like the U.S., despite persistent uncertainty around specific assets like Ethereum.