Crypto liquidations have surpassed $210 million, with long contracts making up an amazing 85% of the total. This is because the market is still in a state of chaos.

Cryptocurrency markets have been shaken up by large liquidations, according to data compiled by crypto analytics company Coinglass. Bitcoin (BTC) has dropped 4% in the last 24 hours. Both long and short traders have had their holdings liquidated for a total of 92,298 traders, or $210.26 million.

Crypto Absorbs Market Turmoil.

Long positions were hit the hardest by the trouble, and a big chunk of their assets—$178.2 million—were sold off. Short positions, on the other hand, lost $32.05 million. The fact that 84.7% of the trades that were closed were long positions shows how quickly market opinion changed from bullish to bearish.

The recent drop in Bitcoin’s value from its April 23 high point of $67,183 is what caused the current market instability. After this high, BTC went through a big correction that ended with a 3.2% drop by the end of yesterday’s trade session. This downward trend has continued, which is why Bitcoin broke through the highly important $64,000 mark earlier today.

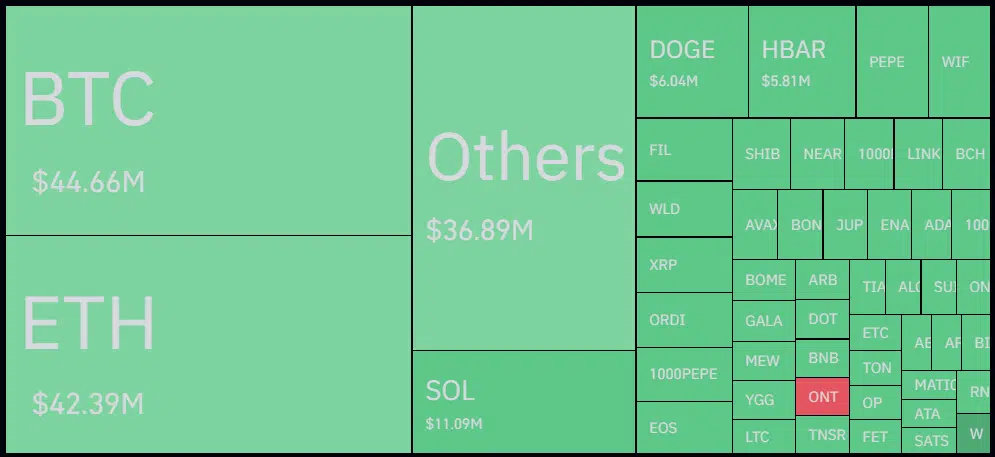

As a result, altcoins are facing more and more negative pressure, and the global cryptocurrency market capitalization has dropped by 3.87% in the last day, reaching $2.47 trillion. As the most well-known cryptocurrency, $44.6 million worth of Bitcoin has been sold in just 24 hours, making it the most active of all crypto assets.

On April 18, before the most recent Bitcoin split event, the market was showing a clear trend of liquidations, which led to losses of $247 million. The April 20 halving of Bitcoin, on the other hand, gave the market new hope, which led to a rise in long positions during the rebound.

In spite of the recent rise in liquidations, trade volume in the derivatives market has gone through the roof, rising 30% in just one day to a total of $159 billion at the time of reporting. The rise in short positions is what caused this rise. The ratio of long to short positions is now 0.7832.