Blockchain technology company CryptoQuant says that buyers are buying a lot more Ethereum (ETH). The Coinbase Premium Gap, which measures the price difference between Coinbase and Binance for ETH, makes this trend very clear.

In the U.S , a drop in this gap means that investors are either selling ETH or not buying it, while a rise in the gap means that investors are being very aggressive in buying.

The Coinbase Premium Gap recently jumped to 0.78, which shows that American buyers are very interested in buying. Analysts say that this increased interest in Ethereum is probably due to the upcoming start of the Ethereum ETF, which has caused a lot of excitement in the market.

Ethereum Price Major Surge

Historically, changes in the Coinbase Premium Gap have had significant impacts on the price of ETH. The gap fell to one of its lowest points in March 2023, which caused ETH to fall below $1,400. On the other hand, by March 2024, the gap was at its widest, which drove ETH up to $4,065.

ETH was selling at $3,194 at the time of this writing, 34.70% less than its all-time high. But if the current buying trend in the U.S. and around the world continues, ETH might be able to make up for some of these loses.

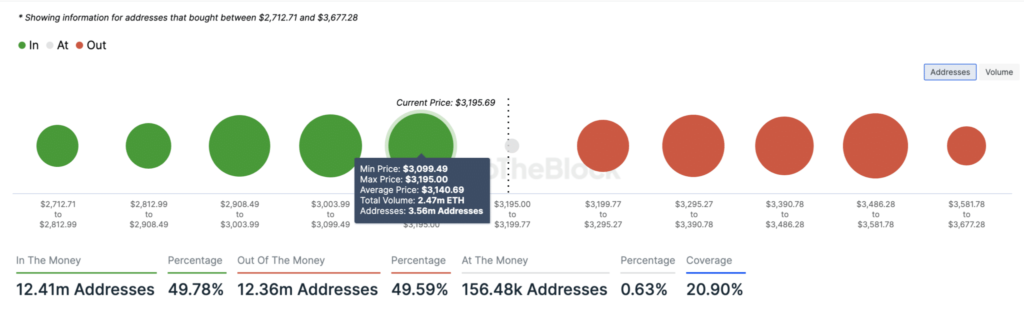

More information from IntoTheBlock gives us more information about how the price of ETH might change. Based on how Ethereum addresses are spread out, the platform’s IOMAP (In/Out of Money Around Price) metric shows high support and resistance levels. It also shows key buying and selling zones.

At the moment, 3.56 million ETH addresses have bought 2.47 million ETH at an average price of $3,140, putting them “in the money.” On the other hand, 2.02 million addresses bought 4.01 million ETH for $3,242, which means they are “out of the money.”

Because there are a lot of addresses that are “in the money,” ETH might be able to break through the $3,242 level of support. The next goal could be $3,347 if this happens.Analysts also looked at the Ethereum Fear and Greed Index to get a sense of how the market felt.

This index has a number between 0 and 100. Values close to 0 show fear and values close to 100 show greed. At the moment, the measure is 39, which means that the market is not overly fearful or overly greedy.